After the supervision of the central bank, Alipay was officially "incorporated"!

CCTV News:October 15th is an important day for third-party payment institutions in China, such as Alipay and Tenpay.

According to the requirements of the central bank, banks and payment institutions should complete the preparations for accessing the network platform and business migration before October 15. At present,More than 20 payment institutions and banks have completed the access work., including third-party payment institutions such as Tenpay and Alipay.

The central bank requires all third-party payment institutions to access the network.

On August 4th this year, the Payment and Settlement Department of the Central Bank issued the Notice of the Payment and Settlement Department of the People’s Bank of China on Transferring the online payment business of non-bank payment institutions from the direct connection mode to the online platform for processing.

The notice stated that,Since June 30, 2018,All online payment services involving bank accounts accepted by payment institutions are handled through the network platform. Banks and payment institutions shouldBefore October 15th, 2017Complete the preparatory work related to access to the network platform and service migration.

The networking platform is just a clearing platform and does not carry out payment business.

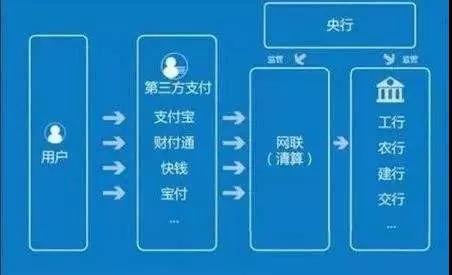

Netlink, also known as "Online UnionPay", is a unified clearing platform for online payment, which was organized and established by China Payment and Clearing Association under the guidance of the central bank to handle the payment business initiated by non-bank payment institutions and interacting with banks, and jointly initiated the preparation according to the principle of "co-construction, co-ownership and sharing".

Netlink is only a clearing platform, and it does not directly carry out payment business to maintain neutrality.

The establishment of the network link can, to a certain extent, correct the problem that third-party payment institutions engage in inter-bank clearing business in violation of regulations and change the multi-head connection between payment institutions and banks to carry out business. That is to say,The online payment channel of third-party payment institutions does not need and can no longer directly connect with banks, but directly connect with banks through the network platform.

Why promote the establishment of the network? Conducive to supervision

In fact, the intention of the central bank to promote the establishment of the network is very obvious:Conducive to supervision.

In recent years, the rapid development of the third-party payment industry has caused confusion in the payment and financial markets.The establishment of the network link can prevent and deal with risks such as fraud, money laundering, fishing and violations through trusted services and risk detection.

To some extent, networking can reduce the tedious process of direct connection between banks and many third-party payment institutions, especially some small and medium-sized banks. Network connection can make the rights and responsibilities of all parties involved in payment gradually become more clear, clear and independent.

Prior to this, the fees between payment institutions and banks were drawn up by a number of third-party payment institutions and banks respectively, and the multi-party relationship was rather chaotic.

After the completion of the network link, the third-party payment companies and banks will face a change from "n" to "1", and all interfaces will lead to the network link, and the network link interfaces will have the same price.Can avoid the influence of the right to speak in the industry on fair competition; It also helps to make the flow of funds clear at a glance and is conducive to supervision.

What impact does the online connection have on the third-party payment industry?

At present, the major domestic third-party payment institutions have all obtained the qualifications to become shareholders in Netlink, including Tenpay, Online Banking, Kuaiqian, Baifubao, Alipay, Ping An Payment and Wing Payment. For third-party payment institutions, what are the effects of being "incorporated" on them?

Impact on large third-party payment institutions: deposited funds were denied.

The establishment of the network connection of the online payment and clearing platform aims to cut off the clearing mode of the third-party payment institution directly connected to the bank, solve the long-troubled problem of centralized management of reserve funds, and theoretically will no longer enjoy the control and income of the deposited funds.

A large number of third-party payment institutions, such as Alipay and Tenpay, have set up multiple reserve accounts, which are complicated and have low transparency. In a sense, the third-party payment institutions have their own payment and settlement systems, but they are outside the existing financial system.

Money laundering is not easy to wash.

Alipay and Tenpay will be "strictly controlled", and each of their transfer transactions will be clearly seen by the central bank. Prior to this, because the transaction was a "direct connection mode", the central bank could not see the "complete capital transfer chain" of third-party payment, which theoretically facilitated money laundering, bribery and tax evasion.

The central bank obtains more financial big data through the network.

The central bank has set up a "network link", which is equivalent to putting a data director between Alipay and users. All the payment and settlement data are finally summarized to the central bank through the network link.

The establishment of the network is not only a heavy blow to purify the financial environment, but also represents the first shot of the new credit system in China led by the state!