Country Garden, which fell out of the TOP10, was "even more difficult": delayed financial report, stock suspension and stock freeze.

Image source @ Country Garden official website

oneSales fell sharply, falling out of the TOP10 of the sales list for the first time.

In the situation that the real estate industry has not been fully improved, and the concerns about a number of negative news in the near future, the sales situation of Country Garden is becoming increasingly severe. According to the latest data released by Kerry, from January to March 2024,Country Garden’s full-caliber sales amounted to 17.68 billion yuan, down 79.9% year-on-year, ranking 12th, falling out of the TOP10 list for the first time.In the same period of 2023, the sales amount of Country Garden still ranked third; Compared with the sales situation of the whole industry, the sales amount of the top 100 real estate enterprises in January-March decreased by 47.5% year-on-year.Country Garden’s decline far exceeds the industry’s decline, and the decline of 79.91% is also the largest among TOP50 housing enterprises.

Judging from the monthly sales in March, Country Garden’s sales were 5.51 billion yuan, down 82.67% year-on-year, which was second only to Evergrande’s -83.43%.

Sales and repayment are one of the most important channels for real estate enterprises to expand cash flow. The rapid decline in sales amount has further deteriorated Country Garden’s own "hematopoietic" ability.

Data source: corporate financial report & Kerry, drawn by Titanium Media APP.

Judging from the sales data over the years, since 2016, Country Garden has started to add leverage crazily and become the "king of hoarding land". In 2015, the sales of Country Garden was 140.2 billion yuan, and in 2016, it directly doubled to 308.8 billion yuan. In 2017, it broke through the 500 billion mark and ranked first in the sales list for the first time; It reached its peak in 2020, with sales of 788.8 billion yuan; From 2017 to 2022, it ranked first in the sales list of real estate enterprises in China for six consecutive years. In 2023, the sales amount halved and fell to the sixth place in the sales list.

In the peak period of sales in 2018-2021, the average monthly sales was 61-65 billion yuan, which fell to 38.7 billion yuan and 18.1 billion yuan respectively in 2022-2023. In the first quarter of 2024, this figure has fallen to 5.9 billion yuan.Some organizations have predicted that Country Garden will reach 40 billion yuan in sales every month, so that it can have sufficient ability to repay debt interest. Judging from the current sales data, it is far from enough.

Insiders pointed out that, looking back, Country Garden’s "high leverage and fast turnover" model of rapid expansion depends entirely on the rapid sale of houses. At present, the speed of selling houses has slowed down, which naturally leads to the difficulty in maintaining the capital chain.

Country Garden once bluntly said: "We underestimated the depth, intensity and duration of the market downturn, failed to take more effective measures as early as possible, failed to see that the relationship between supply and demand in the real estate market has undergone major changes, and failed to understand the potential risks such as excessive investment ratio in third-and fourth-tier cities and insufficient debt ratio pressure drop, and failed to resolve them promptly and forcefully."

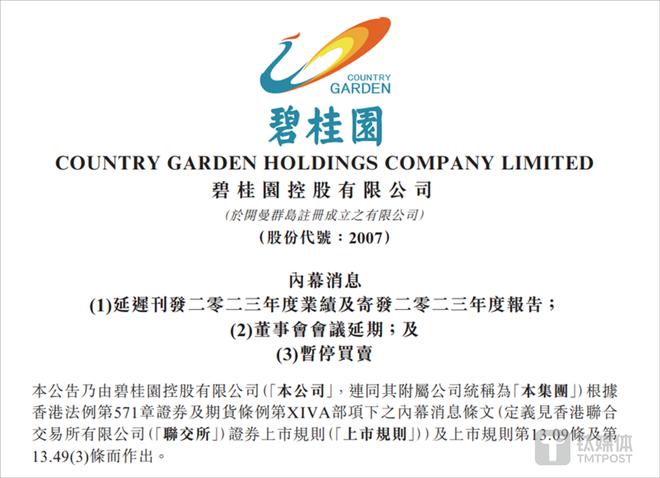

2, delay the release of financial reports, stock suspension, and hire a risk consulting company to conduct liquidation analysis.

In addition to the pressure of sales, its debt restructuring seems to be facing unprecedented pressure.

On the evening of March 28th, Country Garden did not publish the annual performance and financial report for 2023 as planned, but issued a notice saying that,The publication of 2023 annual results will be delayed, and the board meeting will also be postponed. In addition, the company will suspend trading on the Stock Exchange from 9: 00 on April 2.

Country Garden said in the announcement: "The suspension of trading will not have a substantial impact on the company’s operations. At present, the work of Baojiaolou and overseas debt restructuring are progressing in an orderly manner. "

Image source @ Country Garden Announcement

Country Garden gave two reasons for the delay in publishing the 2023 annual results in the announcement:"First, because the industry continues to fluctuate, the business environment faced by the company is becoming increasingly complex, and the company needs to collect more information to make appropriate accounting estimates and judgments; Second, due diligence related to debt restructuring has a large workload and high complexity, which requires more time to collect financial information. "

In fact, Country Garden suffered a loss for the first time in 2022, with a loss of 6.052 billion yuan. In the first half of 2023, the loss continued to expand, and the net loss to the mother core was about 48.932 billion yuan. Three years later, in 2019, 2020 and 2021, its net profit returned to its mother was as high as 39.55 billion, 35.022 billion and 26.797 billion respectively.

Country Garden’s huge losses are mainly due to asset impairment losses. It is reported that 40.3 billion yuan was accrued in the first half of 2023. The decline in average selling price and slow de-capitalization led to an increase in provision for asset impairment; Judging from the recent sales trend and overall layout of Country Garden, the provision for asset impairment may be intensified.

Compared with the annual report, the market is more concerned about the progress of Country Garden’s debt restructuring and whether it will eventually be liquidated like Evergrande.

On October 10, 2023, Country Garden said that the company had not paid the due amount of HK$ 470 million, which caused a debt default, and announced the official start of overseas debt restructuring. Country Garden also hired China International Finance Hong Kong Securities Co., Ltd. and Hualian Nuoji (China) Co., Ltd. as financial consultants and Shengde Law Firm as legal consultants, and then introduced KPMG as the main financial consultant for overseas debt restructuring in 2024 to jointly formulate an overall plan to comprehensively solve the company’s current overseas debt risks. (Details: Country Garden launches overseas debt restructuring)

Six months have passed, but no substantial progress has been announced in overseas debt restructuring. Therefore, on February 28th this year, the creditor Jian Taoji filed a liquidation petition against Country Garden with the Hong Kong High Court.

In addition to the pressure on overseas debts, there are also problems with domestic debts that have been successfully extended before.On March 12th, the news that Country Garden’s bond’ H1 Bidi 01′ (original name’ 21 Bidi 01′) failed to pay all the interest due became the focus of the market. Country Garden responded that the interest fund of RMB 96 million of "21 Bidi 01" due to the failure of sales recovery and the pressure of fund allocation on March 12 has not been fully paid. (Details: Country Garden debt interest payment enters grace period)

Previously, Country Garden has hired Kroll, an American risk consultancy company, to conduct liquidation analysis before the court hearing in mid-May. Kroll will conduct an independent business review of Country Garden and predict the recovery ratio of creditors in the case of liquidation.

In the "suspension of trading" announcement, Country Garden said: "The company attaches great importance to debt risk resolution. In the past few months, the company has been working with financial consultants and legal consultants to evaluate the Group’s situation and formulate debt restructuring plans to alleviate the current liquidity problem. Country Garden hopes that all stakeholders will maintain their confidence in the company and support the company to continue its efforts to promote the best practical restructuring plan and achieve a long-term and sustainable capital structure. "

threeMany of its companies have been frozen with equity exceeding 10 billion.

Country Garden’s recent pressure goes far beyond this.

According to the eye-catching survey, recently, Country Garden Real Estate Group Co., Ltd. has added a number of pieces of information about stock right freezing. The enterprises whose shares have been executed include Guangzhou Yuedong Country Garden Investment Co., Ltd., Shenzhen paladin Phase V Equity Investment Partnership (Limited Partnership), Shenzhen Huixin No.22 Investment Consulting Partnership (Limited Partnership), Shenzhen Biji Industrial Development Co., Ltd., etc. The amount of stock right freezing ranges from 39 million yuan to 6.705 billion yuan, and the total stock right freezing exceeds 10 billion yuan.

Image source @ Tianyancha official website

Country Garden responded by saying that due to disputes with the partners in cost calculation and pre-distribution of profits, the partners applied to the court for property preservation. This kind of dispute is a normal commercial dispute, and the court has not yet made a final judgment. The value of the frozen equity is not the same as the subject matter of the dispute. Country Garden is ready to raise an objection to the excessive preservation of the partner.

For Country Garden, the sales rebate is not strong, so we can only rely on new financing to repay the debts due and promote the work of "guaranteeing the delivery of the building".As of March 15th, 272 projects in Country Garden have been included in the "white list" and have received financing support of about 1.732 billion yuan, which can accurately promote the task of "guaranteeing the delivery of buildings". In addition, on March 24th, Country Garden revealed that it plans to introduce Guangdong Zhongwei Investment Control Technology Group Co., Ltd. to develop and build a complex project in White Swan Pond Business District, Liwan District, Guangzhou, and Guangdong Zhongwei will provide 2.8 billion yuan of construction funds after entering the company.

It is worth noting that these can only solve the single project and short-term crisis of Country Garden. In order to solve the liquidity risk, debt restructuring and the recovery of the sales market are very important. (This article first appeared in Titanium Media APP, author | Wang Jian, editor | Liu Yangxue)

For more macro research on dry goods, please pay attention to titanium media international think tank WeChat official account: