List of government bonds issued by 31 provinces and cities in the first half of the year: Shandong ranked first with 259.9 billion yuan.

Local governments are short of money, so they can borrow money by issuing local government bonds. How did 31 provinces (autonomous regions and municipalities directly under the Central Government) issue bonds and borrow money in the first half of this year?

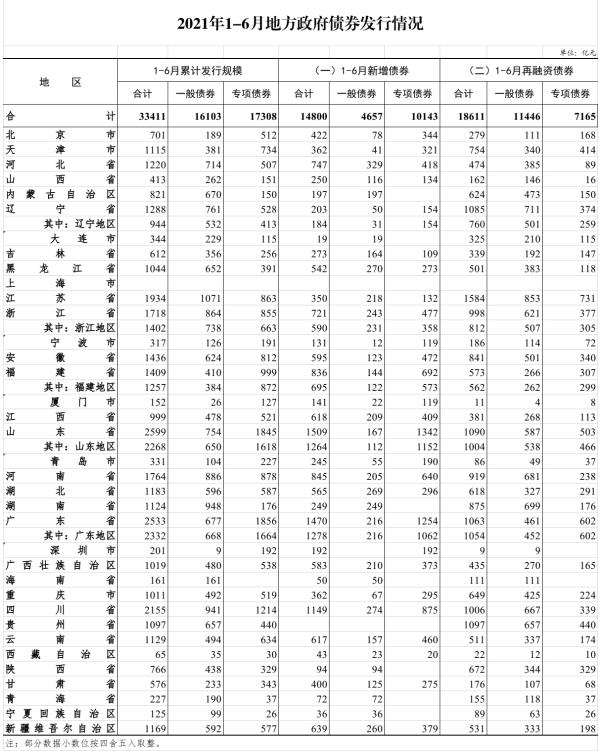

On July 26th, the Ministry of Finance released the issuance of local government bonds in 31 provinces in the first half of this year. In the first half of the year, 31 provinces in China issued a total of 3,341.1 billion yuan of local government bonds.

Judging from the scale of issuing bonds and borrowing money in the first half of the year, Shandong (including Qingdao) temporarily ranked first with 259.9 billion yuan, Guangdong (including Shenzhen) followed closely with 253.3 billion yuan, and Sichuan ranked third with 215.5 billion yuan. The scale of bond issuance in other places is less than 200 billion yuan.

Among them, Jiangsu, Zhejiang, Henan, Hebei, Liaoning, Tianjin, Heilongjiang, Anhui, Fujian, Hubei, Hunan, Guangxi, Chongqing, Guizhou, Yunnan, Xinjiang and other 16 places issued bonds between 100 billion yuan and 200 billion yuan. The remaining provinces and cities issued less than 100 billion bonds, of which Shanghai did not issue local government bonds in the first half of the year, and Shanghai officially issued bonds in July.

Of course, due to the different amount of bonds issued by different places and the different progress of issuing bonds, the scale of bonds issued by different places may change in the end.

Judging from the situation of last year, the top five bond issuance scales were Shandong, Jiangsu, Guangdong, Sichuan and Zhejiang.

A number of local debt experts told CBN that local government bonds are divided into new bonds and refinancing bonds according to their purposes, in which refinancing bonds can only be used to repay existing debts, that is, borrowing new ones and returning old ones. At present, the total amount of new bonds and refinancing bonds of local governments in China is decided by the National People’s Congress, and the Ministry of Finance distributes this total amount to 31 provinces and cities.

Generally speaking, the Ministry of Finance will take into account local financial strength, debt risk, financing demand, project maturity, national macro-control needs and other factors when allocating new bond issuance quotas. Generally speaking, the stronger the local government’s financial strength, the lower the debt risk, the more it undertakes major central project expenditures, and the greater the financing demand, the greater the amount of debt issued, and vice versa. The quota allocation of refinancing bonds pays more attention to the maturity scale of local bonds.

According to the data of the Ministry of Finance, of the 3,341.1 billion yuan of government bonds issued by local governments in the first half of this year, 1,480 billion yuan of new bonds were issued and 1,861.1 billion yuan of refinancing bonds were issued.

Judging from the scale of new bond issuance in 31 provinces in the first half of this year, it is still the top three in Shandong, Guangdong and Sichuan. However, in the ranking of the issuance scale of refinancing bonds in the first half of the year, Jiangsu ranked first with 158.4 billion yuan, Guizhou ranked second with 109.7 billion yuan, and the issuance scale of Shandong, Liaoning, Guangdong and Sichuan also slightly exceeded 100 billion yuan.

Where did all the money borrowed by local governments in the first half of the year go? Obviously, the above-mentioned 1.86 trillion yuan refinancing bonds are used to repay the government’s stock debts. Then where is the other 1.48 trillion yuan of new bond funds used? At present, the Ministry of Finance has disclosed the investment of about 1 trillion yuan of new special debt funds.

Xiang Zhongxin, deputy director of the Budget Department of the Ministry of Finance, recently said at the press conference of fiscal revenue and expenditure in the first half of the year that according to the unified deployment of the State Council, major national regional strategic projects such as coordinated development of Beijing-Tianjin-Hebei, development of the Yangtze River Economic Belt and Guangdong-Hong Kong-Macao Greater Bay Area construction have been included in the key support scope of special bonds of local governments in 2021. According to the preliminary summary, about half of the new special bonds issued by local governments in China from January to June were invested in major projects in transportation infrastructure, municipal and industrial parks; About 30% invested in affordable housing projects and major projects in social undertakings such as health, education, old-age care and cultural tourism; About 20% invested in major projects in agriculture, forestry, water conservancy, energy, urban and rural cold chain logistics and other fields.

Therefore, the new bond funds are mainly used for major livelihood infrastructure construction projects. In the first half of the year, due to the strengthening of local debt supervision and the small pressure of steady growth, the progress of local bond issuance was slow, and the scale of new bond issuance in the first half of the year was almost "waist-cut" compared with the same period of last year. However, the issuance of local bonds has accelerated recently. According to the annual budget, the new limit of local bonds is 4.47 trillion yuan, and the scale of local new bonds issued in the second half of the year is close to 3 trillion yuan.