Author Wu Shixue

Edited by Wu Shixue and Michelle ChenMiao

Opening:

On December 4, 2019, the first "China Kangyang 30 People" Forum was held. Gao Jianguang, director of the Capital Utilization Supervision Department of the Insurance Company of the Ministry of Finance of China Banking and Insurance Regulatory Commission, China, revealed that by the end of September this year, 10 insurance institutions including China Life Insurance, Taikang Life Insurance and Taiping Life Insurance had invested in 47 community projects for the aged, which were distributed in 20 provinces and cities such as Beijing, Shanghai, Hainan, Jiangsu, Guangdong and Anhui, with a total bed size.

At the same time, the total amount of insurance funds invested in private equity investment funds in the upstream and downstream medical and health industries of pension and pension industries has reached 234.782 billion yuan.

According to the Report on the Development Model and Practice of Long-term Care Insurance in China issued by CPIC Allianz, it is estimated that the market size of China’s pension real estate will reach 7.7 trillion yuan in 2020 and 22.3 trillion yuan in 2030.

Three large insurance companies: China Ping An, China Taiping and Taikang Insurance invested more than 41 billion yuan in the field of pension real estate. Insurance companies such as China Life Insurance, China Pacific Insurance, New China Life Insurance, Sunshine Life Insurance, Hezhong Life Insurance, Qianhai Life Insurance, Evergrande Life Insurance, Junkang Life Insurance and Renhe Life Insurance have also announced or substantially intervened in the investment in the old-age community, and the total investment and planned investment has exceeded 100 billion yuan.

It can be seen that since 2006, insurance companies represented by Hezhong and Taikang entered the pension industry, the natural complementary gene of insurance+pension has been fully verified, and the insurance department has become one of the important forces participating in the investment+operation of the pension industry, and more innovative models will be born in the future.

This time, AgeLifePro will systematically review the motivation, participation mode, development process and future trend of insurance companies participating in the pension industry, hoping to bring some valuable reference to the pension industry.

catalogue

First, why do insurance companies have laid out old-age care?

Two, six innovative models of insurance companies participating in the pension industry

Third, the development process of the insurance company’s layout pension

Fourth, the echelon and location layout of insurance companies to develop old-age care

V. Five Future Trends of Insurance and Pension

VI. Insurance+Pension: Pension Layout of 12 Insurance Companies

Seven, insurance companies to develop pension in a variety of ways.

-The full text is 17,145 words-

part1

Why do insurance companies have laid out their pensions one after another?

one

policy support

The policy has experienced a progressive process from caution, to liberalization, and then to rational regulation. In 2009, the China Insurance Regulatory Commission issued the Measures for Insurance Investment in Real Estate and the Measures for Insurance Investment in Equity, which allowed insurance companies to invest in real estate and corporate equity, thus opening the prelude to policies to encourage insurance companies to enter the pension industry.

On November 19th, 2009, with the support of policies, China Insurance Regulatory Commission issued the Notice on Filing Taikang-Pension Community Equity Investment Plan, and approved Taikang to set up a pension community. In 2010, Taikang House was established, which indicated that the policy of insurance investment for the aged really landed.

Figure: Measures for the Administration of the Use of Insurance Funds

After the insurance companies have invested heavily in assets, the policies have become more rational and perfect. On January 24, 2018, the China Insurance Regulatory Commission issued the Administrative Measures for the Use of Insurance Funds (the "Measures for the Use of New Insurance Funds"). The new measures have two new principles: First, the use of insurance funds must be aimed at serving the insurance industry (that is, the well-known "insurance surname"), and second, the use of insurance funds should adhere to independent operation and not be interfered by shareholders in violation of regulations.

In addition, the new measures for the use of insurance funds and the Outline of the 13th Five-Year Plan for the Development of Insurance Industry in China issued by the China Insurance Regulatory Commission also mentioned that insurance funds should be allowed to invest in asset securitization products, broaden the service fields of insurance funds, and innovate the use methods of insurance funds (encouraging the establishment of professional insurance asset management institutions such as real estate, infrastructure and pension, and allowing professional insurance asset management institutions to set up mezzanine funds, merger and acquisition funds, real estate funds, etc.).

2

Focus on the development of insurance companies themselves

1. Investing in heavy assets for the aged can improve the solvency of insurance companies.

In the early days of insurance companies entering the pension industry, the investment speed of insurance companies is very fast. By investing in the pension community, we can evaluate and increase the value, create income on the books and improve the solvency. However, it is worth mentioning that after 2017, due to the control of the proportion and solvency of large-scale assets by the China Insurance Regulatory Commission, the feast of evaluating and increasing the value of insurance companies’ investment in pension communities will no longer be available, and insurance companies will no longer be able to obtain solvency, but will be discounted accordingly.

2. It is conducive to alleviating the pressure of "mismatch between long and short" of insurance funds.

There are abundant insurance funds and a large number of investable assets, but at present, the funds mainly enter short-term investment channels such as bank deposits and government bonds, and the investment channels are relatively single, resulting in a mismatch in the maturity of assets and liabilities. As a comprehensive service industry, providing for the aged needs a certain amount of time to settle the service. Considering the long construction period of the old-age community and apartments for the elderly, it also needs a long-term and stable source of funds. Matching the two can alleviate the pressure of "mismatch between long and short" of insurance funds.

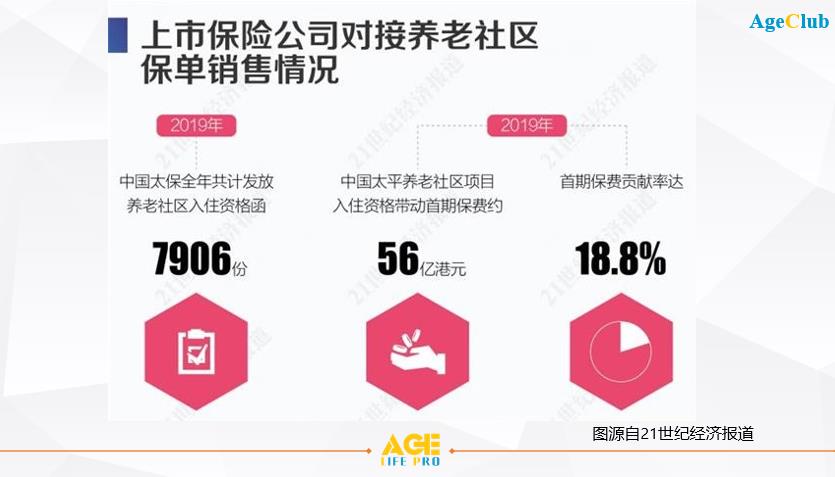

3. Promote policy sales.

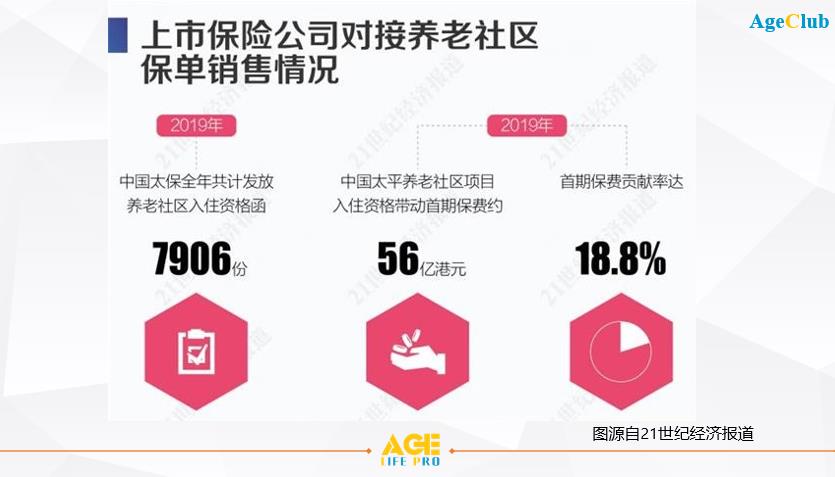

Figure: Policy sales of listed companies docking with pension communities

The expiration and renewal of commercial insurance has always affected the stable operation of insurance companies. Insurance companies link insurance products with pension services and pension real estate membership, which can increase the attractiveness of insurance products, form differentiated competition, provide customers with more choices, improve customer stickiness and promote policy sales.

According to the survey of 21st century business herald, in 2019, CPIC issued 7,906 qualification letters for the elderly community; The occupancy qualification of Taiping Pension Community Project drove the initial premium of about HK$ 5.6 billion, and the contribution rate of the initial premium reached 18.8%, which became an important contribution force for Taiping’s life insurance companies to promote the growth of new orders.

4. Extend the industrial chain

The rapid development of the old-age care industry has spawned more and more formats. In addition to large-scale old-age care communities with heavy assets, there are also various lightweight service projects covering all aspects of the lives of the elderly. The distribution of insurance funds for the aged can deepen the existing life insurance customers, create services for the elderly around the whole life cycle, link up with engineering insurance, and link down with medical insurance, nursing insurance, endowment insurance, door-to-door service, etc., and then drive the overall development of the company and provide the comprehensive income of the company.

part2

Six innovative modes of insurance enterprises participating in pension industry

one

Real estate investment model based on old-age community

Since Taikang Home built a large-scale community for the aged (CCRC) on a large scale, this model has also become the "correct" idea for insurance companies to intervene in the elderly. This model is based on real estate, and only with the right to use or property rights of real estate can we get the corresponding pension services.

This investment model attaches great importance to asset layout, which can give full play to the comprehensive advantages of insurance companies and integrate development, investment and operation. At the initial stage of entering the pension industry, it was favored by some head insurance companies.

Under the old-age real estate model, the elderly can live in by paying a deposit and a monthly fee, or they can become members, or they can buy relevant insurance products to lock in the right to live in the old-age community in advance. Union Life’s insurance policy+physical endowment insurance plan, Taikang’s "Happiness with a Contract" insurance product innovatively links virtual insurance products with physical communities.

While Taikang, Taiping and China Life successively built large-scale old-age care communities and sold the right to use them, Ping An Real Estate Co., Ltd. also launched the first old-age care project that can sell property rights in Tongxiang City, Zhejiang Province.

In addition to the typical CCRC product types, everyone insurance cooperates with BTG to build an urban pension complex by means of light asset leasing; New China Life Insurance transformed its office building into an apartment for the elderly and a rehabilitation hospital, which means that insurance companies have begun to cover the "urban institutional pension scene".

2

The service mode of going deep into the scene of community home-based care for the aged.

This model mainly provides old-age services for the elderly at home in the community. Insurance companies take advantage of their abundant policy information to provide corresponding intermediary services and charge relevant intermediary fees. This model has a good development prospect in the future under the overall situation that community homes occupy the mainstream of old-age care in China.

Because insurance companies only appear as service intermediaries or traffic platforms in this mode, the investment is light, and large, medium and small insurance companies can participate.

Photo: Love Life "Love+Home Care Service Plan"

Love Life launched the industry’s first "Love+Home Care Product Plan" and became a leading explorer in the field of home care. This product includes a complete set of home care service system and builds an efficient service platform. Combining medical care with nursing care, through the "1+N" consulting professional service, we can solve the comprehensive needs of medical care, pension, nursing and rehabilitation in one stop.

In the early days of entering the old-age care industry, Taikang also took community home-based care for the elderly as the entry point. In January 2008, Taikang Home Wangjing Senior Club officially opened, but this exploration was unsuccessful, which eventually prompted Taikang to choose the heavy asset CCRC model.

three

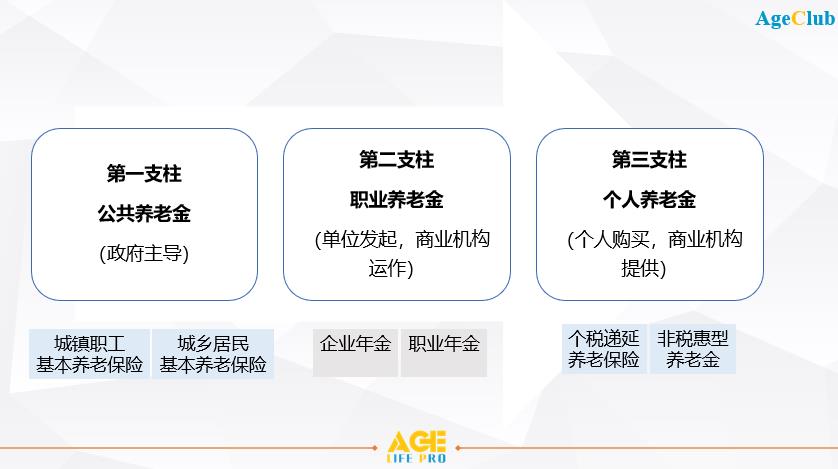

Establish a professional endowment insurance institution

Since the establishment of the first pension insurance company in December 2004, there are currently nine professional pension insurance institutions in China, namely, caring for the elderly, China Life Pension, Taiping Pension, Yangtze Pension, Taikang Pension, Ping ‘an Pension, Xinhua Pension, Everyone Pension and Hengan Standard Pension, all of which were initiated by medium and large insurance groups.

The core business of pension insurance companies can be divided into trust-based asset management business and contractual commercial insurance business. Trust-based asset management business mainly includes enterprise annuity, occupational annuity, pension products, old-age security management products and third-party asset management business (issuing insurance asset management products and conducting fund management in special accounts of third-party institutions). Contractual commercial insurance business mainly includes health insurance, accident insurance and pension insurance. The specific business situation varies depending on the business development path of each insurance company.

four

Innovation of financial products for the aged

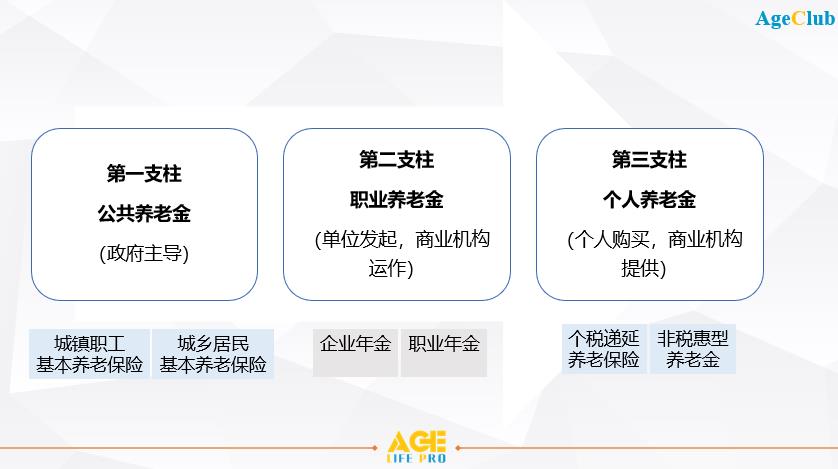

Figure: China’s three-pillar pension system

This model fits the insurance company’s industry. On the one hand, insurance companies can enrich the supply of commercial endowment insurance products and meet the differentiated endowment insurance needs of customers. Support qualified commercial insurance institutions to actively participate in personal tax deferred commercial pension annuity insurance and innovate housing reverse mortgage pension model. Happiness Life Insurance and People’s Life Insurance both operate reverse mortgage insurance business for personal housing pension.

On the other hand, participate in long-term care insurance. At present, the policy is vigorously encouraging commercial insurance to enter the field of nursing insurance. With the gradual expansion of the pilot scope of the long-term care insurance system, commercial insurance companies can play more roles in the future, and work with the government, individuals and other relevant parties to open up the payment system and promote the development of community embedded institutions. Taikang, China Life Insurance and Qianhai Life Insurance all participated in or calculated to participate in the field of long-term insurance.

five

Construct an ecological circle of insurance+medical care+pension

In this mode, insurance companies often pay attention to medical investment, and give full play to the comprehensive advantages of insurance, medical care and service from both online and online perspectives, so as to build a service ecosystem and realize the closed-loop business of B2B2C, in which pension is an important part.

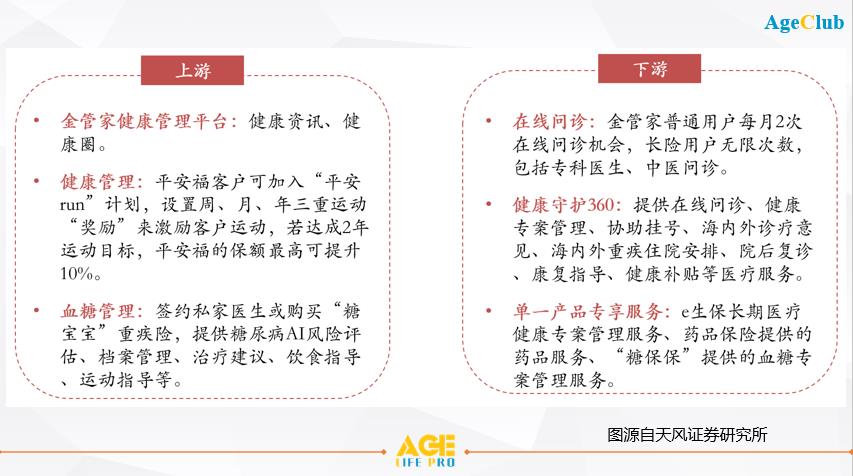

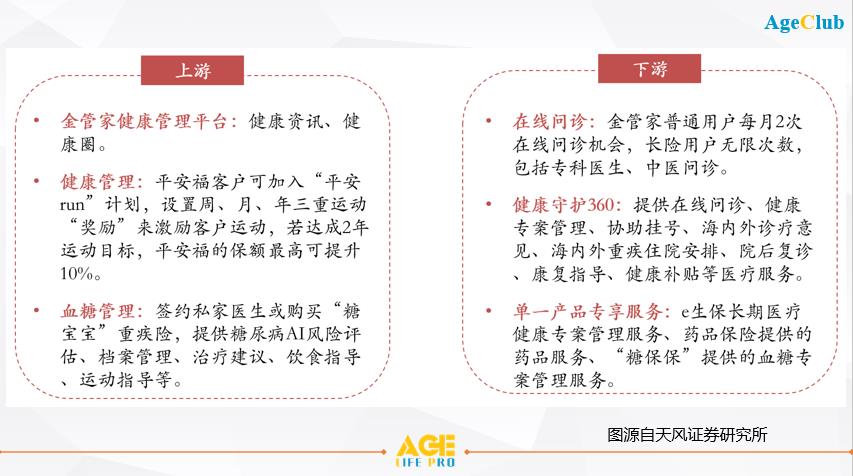

Figure: Ping An Health Care Service Chain

Ping An has created an "insurance+health care" ecosystem, striving to achieve an online+offline health ecosystem of "upstream health prevention, midstream economic compensation and downstream medical services", and provide customers with life-cycle health management and medical services.

Photo: Pacific Insurance "Insurance+Health+Pension" Ecosphere

Similarly, one of the important directions of CPIC Pension Transformation 2.0 is to build an "insurance+health+pension" ecosystem. Among them, "Pacific Insurance Blueprint" medical service, "Pacific Insurance Wonderful Health" health interaction plan and "CWI Health Examination Center" constitute the "insurance+health" ecosystem; Through its life insurance companies, pension investment companies, Yangtze River pension, and cooperation with Pacific Oubaoting and third-party service providers, it constitutes an "insurance+pension" ecosystem. These two ecological circles can cooperate with the main insurance industry and realize ecological integration.

Sunshine Life Insurance and Qianhai Life Insurance respectively invested in the establishment of Sunshine Fusion Hospital and Guangzhou General Hospital of Qianhai Life Insurance, believing that there will be a further layout in building a healthy ecosystem in the future.

six

Underwriting comprehensive liability insurance for pension institutions

The daily operation of old-age care institutions will face various risks, and building a sound risk prevention and control system has become an important part of the smooth operation of old-age care institutions. Especially for some large-scale old-age care institutions, asking professional insurance companies to design relevant risk protection products can effectively avoid losses and prevent accidents.

According to the Notice of Beijing Civil Affairs Bureau on Relevant Matters Concerning the Implementation of Comprehensive Liability Insurance for Aged Services (J.M.F.F. [2012] No.424), in September 2012, People’s Insurance Company, Ping ‘an Company and China Life Company became comprehensive liability insurance underwriting companies for aged services in Beijing through government bidding.

part3

The development course of insurance enterprises’ layout pension.

one

Review of the course of insurance enterprises building old-age community

2006-2012: Reference and Exploration Stage

Taikang, Hezhong, China Life Insurance and other insurance companies have visited the United States and Japan to inspect the operation experience of mature old-age communities and explore the construction and operation methods of old-age communities. In November 2009, Taikang Life Insurance took the lead in obtaining the permission of the China Insurance Regulatory Commission to obtain the pilot qualification of investing in the old-age community.

2012-2015: Initial stage of construction

The idea of insurance companies investing in the old-age community has become clear, and the old-age communities invested by insurance companies such as Taikang, Xinhua, Hezhong, Ping An and Taiping have been opened one after another.

In June 2012, the foundation stone was laid for "Taikang House-Yanyuan";

In June 2012, the foundation stone was laid for Xinhua Life Insurance "Xinhua Home" in Beijing;

In September 2012, the "Comprehensive Service Community for Health Care and Pension" invested by Ping An Life Insurance Company of China landed in Tongxiang, Zhejiang;

In October 2013, Hezhong Life Insurance established the first insurance pension community in China-"Wuhan Hezhong Younian Life Pension Community";

In October 2014, the foundation stone of "Wutong Family" of Taiping Life Insurance was laid in Shanghai …

2015-present: accelerate the layout stage

Insurance companies have accelerated the layout, more insurance companies have joined, and they have participated in the old-age care in different cities across the country in two ways: heavy assets and light assets.

By 2020, Taikang has laid out key provinces and cities in China, covering 22 cities in the core areas such as Beijing-Tianjin Wing, Yangtze River Delta, Guangdong-Hong Kong-Macao Greater Bay Area, Southwest China and Central China, among which 7 communities have opened, forming a chain operation trend in the east, west, north and south of the country;

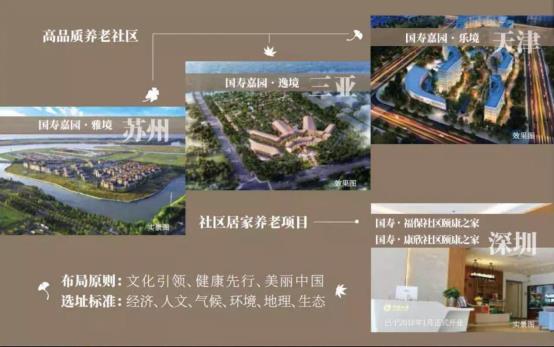

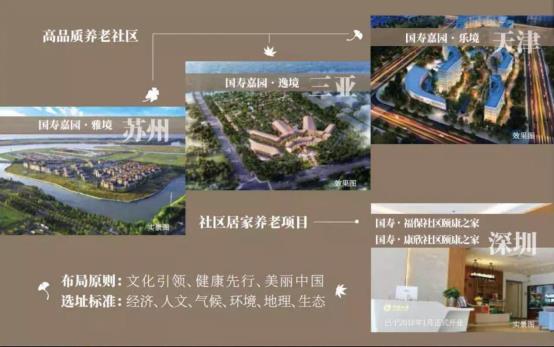

China Life has the layout of Guoshou Jiayuan Yunjing (Beijing), Yijing (Tianjin), Lejing (Tianjin) and Yajing (Suzhou), and it also has two home-based retirement projects: Guoshou Kang Xin Community Yikang Home and Guoshou Fubao Community Yikang Home.

Taiping Life Insurance’s old-age community, Shanghai Taiping Wutong Family and Taiping Town Haitang Family, has now opened. In addition, Taiping cooperation projects include Shanghai Happy Home, Ningbo Xingjian Lanting, Dalian Yifang Yijinghui, Kunming Ancient Yunnan Famous City, and Beijing Contemporary Time;

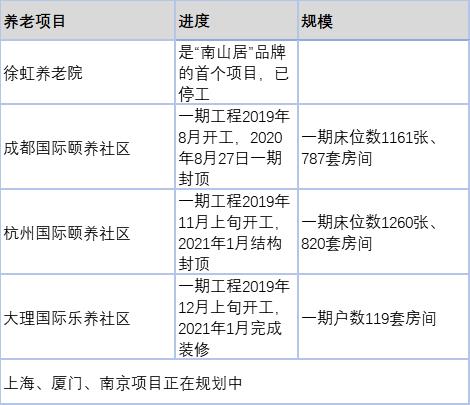

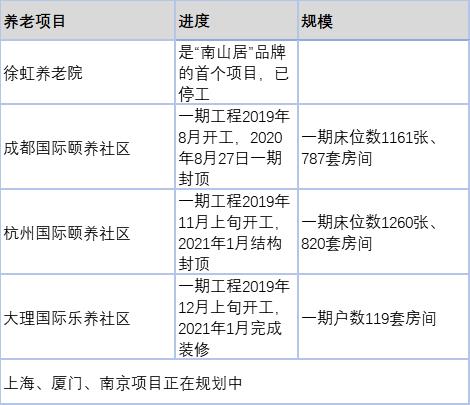

The layout of China Pacific Insurance includes Chengdu International Support Community, Hangzhou International Support Community and Dali International Music Support Community. These three projects have all started, but they have not yet opened …

In addition, insurance companies such as Junkang Life Insurance, Tongfang Global Life Insurance, China Insurance, PICC Life Insurance and Guohua Life Insurance also began to provide for the elderly through investment or cooperation during this period.

2

The insurance companies formally laid out the time point for providing for the aged.

Judging from the time when the insurance companies formally laid out the old-age pension, most of the insurance companies that entered the old-age pension in the early days were large-scale insurance companies, and most of them laid out heavy assets. With the development of time, more and more small and medium-sized insurance companies are also involved in the cause of providing for the aged, and the old-age projects under construction have also changed from CCRC to apartments for the elderly to community home services. In addition, the way insurance companies participate in providing for the aged is more flexible and diverse.

part4

The echelon and location layout of insurance companies to develop old-age care

one

Layout of the four major insurance company echelons for the aged

Looking at the layout of these insurance companies, we can find that they have shown four echelons:

The first echelon is Taikang, Taibao and China Life, which have a clear style of play. Investing in the community for the aged with heavy assets has achieved remarkable results, insisting on the initial intention to continue the national layout, and attaching importance to the combination of medical care and rehabilitation nursing resources allocation.

The second echelon is Taiping and Hezhong. From the original intention to build their own old-age communities in many cities, they finally chose to change from heavy to light, and retreat to advance by means of equity cooperation and acquisition of nursing homes, which can not only reduce the "heavy", but also cut into the key areas of the old-age industrial chain and play an important role in the old-age market in the future.

The third echelon, represented by Xinhua and Ping ‘an, has long been laying out the old-age care and has certain strategic plans, but it is in a state of shallow taste and cautious wait-and-see for the development of old-age real estate.

The fourth echelon is represented by less well-known insurance companies such as Happiness Life Insurance, China Insurance, Love Life Insurance, Guohua Life Insurance, etc. Its mode of developing old-age care is extremely light, and it is innovating and exploring in a certain field. At present, it is mostly in the initial stage of old-age care.

2

The layout of insurance enterprises and the national and urban layout of providing for the aged

1. National layout

From the nationwide layout, Taikang Life Insurance, China Pacific Insurance, China Life Insurance and Hezhong Life Insurance are all based on the whole country, mainly CCRC.

Among them, Taikang Life Insurance has formed a nationwide chain layout, linking 22 cities, with the earliest and most perfect layout.

At present, the community under China Pacific Insurance is still in the process of preparation, which is firmly carried out in accordance with the layout of "East-West Progress, North-South Echo, National Layout and All-Age Chain", and has formed a trinity product system of "suburban support (middle-aged elderly people aged 70-79), living and enjoying (young elderly people aged 50-69) and urban support (over 80)".

China Life has implemented the "three points and one line, evergreen all the year round" pension industry layout, and some of its pension projects are still slowly advancing.

From the beginning, Union Life planned to deploy in second-tier cities nationwide, and finally contracted its strategy. At present, its main projects are located in Wuhan, Shenyang and Nanning, and some private nursing homes have been acquired in the Yangtze River Delta.

Different from the national layout of the above four insurance companies, Taiping Life Insurance has established itself in the Yangtze River Delta, and gradually cooperated with neighboring projects such as Ningbo and even the whole country, such as Dalian, Kunming and Shenzhen, from Shanghai to the whole country. Shouhou Everyone, New China Life Insurance and Sunshine Insurance occupy the layout of pension projects in Beijing. Qianhai Life Insurance started from Shenzhen, and will have strategies in Xi ‘an, Nanning, Chengdu and Hainan in the future.

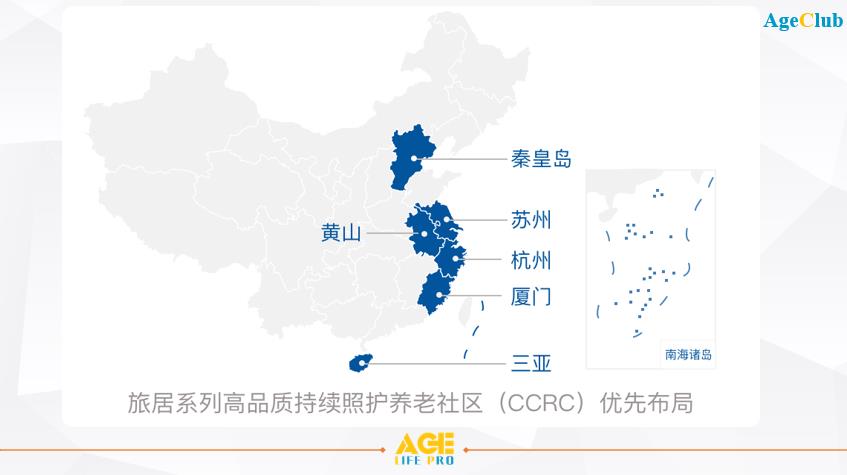

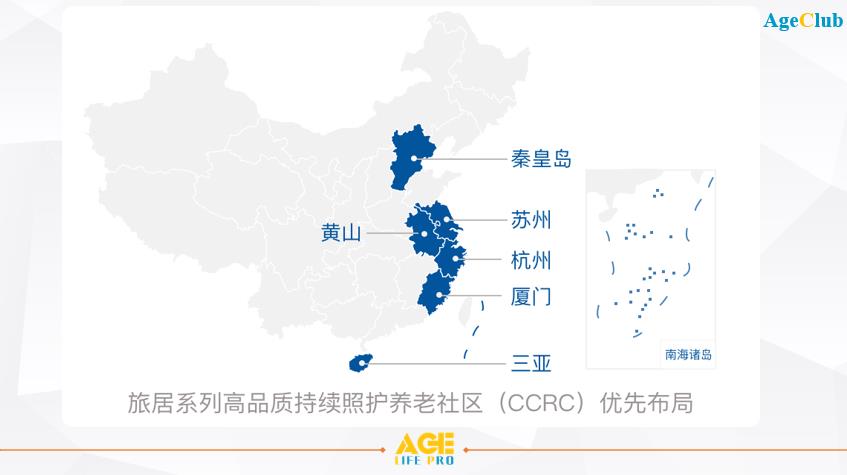

Photo: Everyone’s insurance travel series

Considering the development of the residence market, cities such as Sanya, Dalian, Kunming and Hangzhou are also favored by insurance companies. Insurance companies such as Taikang, Taiping and Hezhong, which have laid out national pension projects, can develop their residence business with the help of pension projects laid out in cities across the country. There are also some insurance companies that have plans to lay out their travel business, such as the travel series products that everyone intends to develop.

2. Urban location layout

In terms of urban location layout, from June 2012, when the foundation stone was laid for Yanyuan, the first old-age care community in Taikang, Beijing, insurance institutions started to build large-scale high-quality old-age care communities in the suburbs, entered the urban areas, and successively laid out some high-quality old-age care institutions. At present, insurance companies such as China Life Insurance, China Pacific Insurance, New China Life Insurance, and Everyone Insurance have all set up pension institutions in urban areas, thus forming a "urban+suburban" product line with full coverage.

According to Litwak, an American scholar, proper service provision for the elderly needs to go through three stages: when the health of the elderly is good, it is most beneficial to live in a community with homogeneous age; When the elderly are disabled, it is most beneficial to live in an age-homogeneous community near their children’s residence; When the degree of disability of the elderly develops to the point where they need 24-hour care, living in a nursing home is the most beneficial.

In the early days, Taikang Insurance, China Life Insurance, China Pacific Insurance, New China Life Insurance, Taiping Life Insurance, China Ping An, Hezhong Life Insurance, Junkang Life Insurance and other large and medium-sized insurance institutions laid out large-scale pension communities in the suburbs as standard. Nowadays, more and more insurance institutions have laid out pension communities in urban areas, such as:

The scheme of "one city chain 1+1" designed by Taibao Jiayuan. That is, the younger elderly can live in the Dongtan Retirement Center of Taibao Home in Chongming for a short time; Middle-aged self-care elders can live in Dongtan Retirement Center for a long time; The elderly with disabilities can be referred to Putuo Kangyang Community through the internal passage of Taibao Home to receive professional care services combining medical care and nursing, and to facilitate relatives to visit nearby;

Everyone’s insurance officer announced the layout mode of "providing for the aged in the heart of the city". At present, there are three old-age care communities located in the urban area of Beijing. In the future, we will start with light assets and lay out high-quality old-age care communities in the core area of the city, which are close to medical care, children and fireworks. "Close to the top three hospitals" will be the primary consideration for the location of old-age care communities;

New China Life Insurance transformed the office building of Liuliqiao in Beijing West Third Ring Road into a high-end nursing home with rehabilitation hospital;

China Life piloted the "Yikang Home of China Life Fubao Community" in Shenzhen.

part5

Prospect of the future trend of insurance+pension

one

Stones from Other Mountains —— American Experience

Figure: Classification of old-age communities according to different service types.

According to the experience of the United States, according to the different clients, the community for the aged can be divided into six types: active elderly community (AAC), independent living community (IL), assisted living community (AL), professional nursing community (SNF), memory nursing community (MC) and continuous care community (CCRC). It can be seen that with the gradual decline of the self-care ability of the elderly, the types of services they need are more and more professional, and the requirements for the residential community are getting higher and higher, especially the ability of professional care and medical treatment.

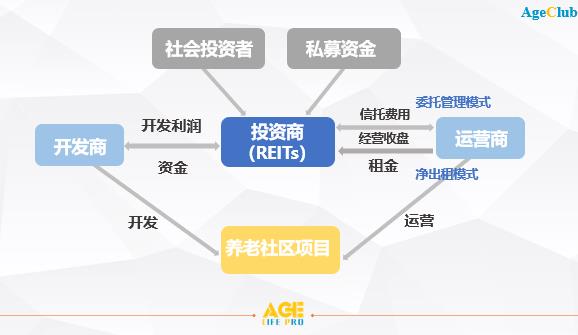

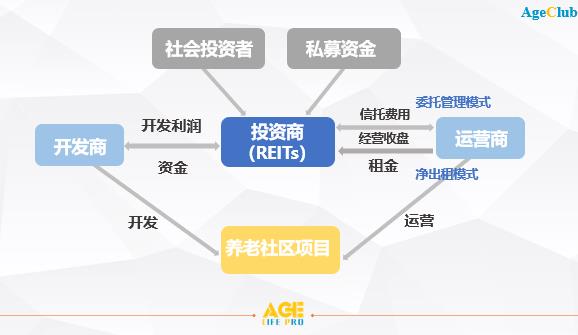

Figure: American pension real estate operation mode

American pension real estate involves investors, developers and operators, who form a complete market-oriented system of financing, construction and operation. Among them, the project manager is separated from the holder. The mainstream investor is Real Estate Trust Fund (REITs), which is responsible for raising funds for the development and operation of the project. Developers are responsible for planning and developing pension real estate projects, and operators operate and manage well-developed projects.

Operators adopt two ways for the project. One is the net lease mode, in which REITs companies rent the property to operators, and the operators charge a fixed rental fee every year, and the operators bear the direct operating expenses, community maintenance fees, taxes, insurance fees, etc. The second is the entrusted management mode, in which REITs entrusts its properties to operators, and the operating costs and income are attributed to REITs.

In addition to REITs model, American pension communities can be divided into two different types according to the developer-led or operator-led: one is the developer-led Sun City model, which is aimed at active health of the elderly aged 55-70 and led by real estate developers, and can recover investment and generate profits through the sale of pension concept houses; The second is the CCRC model led by operators, which takes the form of renting to serve three types of elderly people: self-care, intermediary assistance and intermediary care, and only provides real estate lease rights and service enjoyment rights.

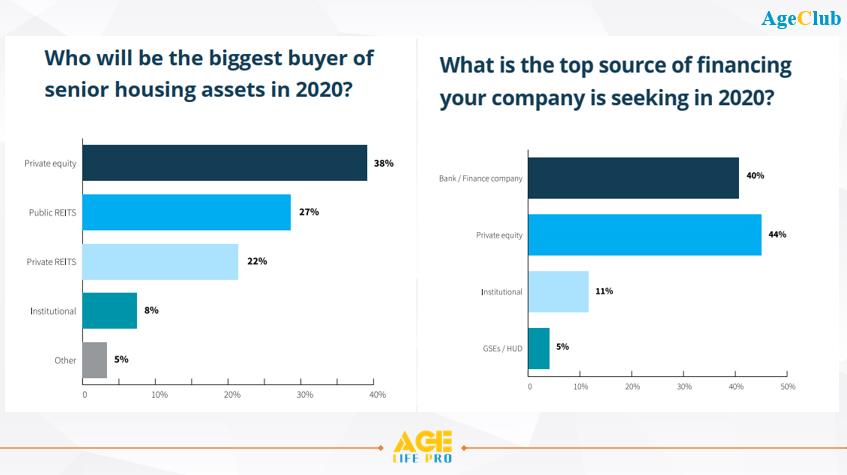

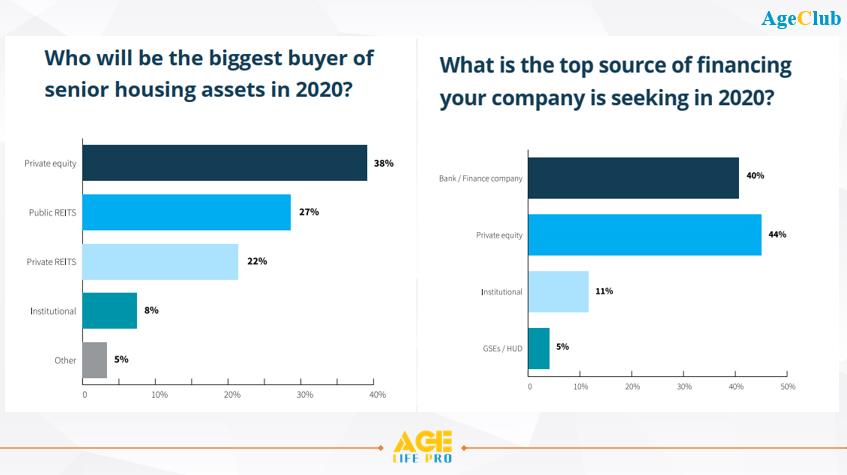

Excerpt from "2020 Senior Housing Outlook Report"

According to the "2020 Senior Housing Outlook Report" published by SHN, in 2020, Private equity, public REITs(Private REITs, Institional institutions, etc. are all buyers of housing for the elderly.

At the same time, the financing sources of American housing for the elderly have expanded, and both Private equity and Bank/Finance company have played a great role in the financing of housing for the elderly.

2

Five Future Trends of Insurance Companies’ Pension Development

Compared with the experience of American pension housing, it is found that the development, investment and operation of China’s pension market are still not very mature. In the past few years, the entry of some large insurance companies and real estate companies has promoted the rapid development of the pension market, but various market participants have not formed a clear division of roles, and many enterprises are integrating investment, development and operation. Until these years, this situation has changed, and there have been more cases of division of labor and cooperation based on their respective professional fields.

Photo: Taiping Life Insurance official website-Taiping Enjoy Home

For example, Taiping Life Insurance has only built Shanghai Wutong Family and the newly opened Sanya Begonia Family. The rest of the projects, such as Shanghai Happy Home, Ningbo Xingjian Lanting, Dalian Yijinghui, Kunming Ancient Yunnan Famous City, Beijing Contemporary Time Li, Suzhou Hecheng and Hangzhou Langhe International Medical Center, are all strategic cooperation projects.

In 2017, Taiping Life joined hands with a third-party organization to launch Taiping Life’s community brand-Taiping Lexiangjia. According to the plan, in the future, at least 16 cities across the country will match the resources of Taiping Lexiang Family Pension Community. Under the unified brand management, all communities in Taiping Lexiangjia carry out standardized management and formulate reasonable and consistent marketing, check-in and check-out procedures. At the same time, the community can also jointly carry out residence business.

In addition, the designated cooperative units of Taiping Life Insurance’s pension service experience include: Yuenianhua Support Center (Shenzhen), Runhua Songhe Support Center (Shenzhen) and Zangmashan Support Community (Qingdao). This mode of cooperation can further make up for the shortcomings of insurance companies in the urban distribution, scale, type and location of pension projects, and provide customers with more choices.

Take China Life as an example. At present, China Life’s community project for the aged is progressing relatively slowly, but it has made some efforts in the field of community home. On December 29th, 2020, the first comprehensive community service center for the aged in Yantian District, which was jointly established by Yantian District Government and China Life Insurance, officially opened. So far, China Life’s community home-based care projects have included: Yikang Home in Fubao Community, Yikang Home in Kang Xin Community, Yuexiang Center in Yantian District, and Youxiangjia Health Care Center in Luohu District under construction.

In addition, Bohai Life Insurance, Tianjin Daji Development Co., Ltd. and Beijing Yangzheng Investment signed a strategic cooperation on the "Home-based Care for the Aged" project in China Jihai Shipping City, Tianjin.

According to the development of the old-age community over the years, zhang yi, vice president of Junkang Life Insurance and general manager of the Health Industry Division, summed up these stages:

Among them, in the "1.0" stage, the property of real estate is stronger, and the procedure is usually in the form of property rights sales of real estate developers and basic old-age services provided by third parties;

The "2.0" stage is a relatively mainstream format with the concept of CCRC in the current market, that is, providing relatively standardized high-quality catering, medical care, care and entertainment services for the elderly in large communities;

In the future "3.0" stage, it will become a trend to realize customization and meet individual needs through science and technology. Specifically, through data mining and intelligent analysis, we can build intelligent systems including smart home, face recognition, mobile housekeeper, vital signs detection, cloud health detection, telemedicine, etc., and provide high-quality and personalized health services and living environment for the elderly through big data analysis.

Figure: Maimai Smart Pension Solution

Therefore, in the future, smart devices and technology will empower the elderly on a larger scale, and insurance companies should also be prepared for this.

On the other hand, insurance companies can also introduce some innovative practices from the main business of insurance, and provide feasible reference ideas for the innovative development of insurance and finance.

Zhu Junsheng, a researcher at the China Insurance and Pension Research Center of Tsinghua University Wudaokou Finance College, said in an interview: "With the increase of the aging population, people’s attention to risks is increasingly shifting from the risk of death to the risk of survival, and more and more attention is paid to old-age care and health … Commercial health insurance and old-age insurance can play a greater role in multi-level medical care and old-age security system."

Figure: Health insurance

As early as 2018, Ping An Insurance launched the first flagship product for the elderly group in its official APP Ping An Health: Ping An I Kangbao Geriatric Care (three-high version), which guarantees "accidental hospitalization+cancer hospitalization" and the insurance age is open to 70 years old, covering the three-high population of "hypertension, hyperlipidemia and hyperglycemia". And such insurance products for the elderly will be more and more.

All the above cases indicate that in the process of developing old-age care, insurance companies have formed five development trends:

1. Pay more and more attention to the direction of light assets, community home and inclusive old-age care, and be more rational and diversified in the layout of old-age care. And more and more emerging insurance companies can also intervene in the cause of providing for the aged in the form of light asset cooperation.

2. Considering the overall situation of home care and community care market, "light assets+heavy services+insurance products" may become a breakthrough point for insurance companies to realize profits in the field of pension real estate. Leaving aside the construction of large-scale old-age communities, insurance companies have a lot of room for innovation in traditional life insurance, long-term care insurance and personal commercial old-age insurance products. If they are matched with community home-based old-age care services, they can further expand the market.

3. With the country giving more support and encouragement policies to the financial innovation of insurance, in the future, insurance participation in pension can amplify the financial attributes of insurance, carry out financial innovation for C-end, and design insurance+pension products with the idea of "combining consumer insurance with savings insurance".

4. Smart devices and technology will empower the elderly on a larger scale. Insurance companies should increase investment in science and technology, break through the "fence" of communities and nursing homes, and provide accurate and thoughtful services for more elderly people with pension needs.

5. Union Life has started to deploy overseas in the industry, and I believe that more insurance companies will participate in it in the future. Foreign pension enterprises are more mature and have a lot of high-quality and cheap assets, which are worth investing by China insurance companies. Moreover, with the hot development of residence, including foreign travel routes will be more popular with customers.

part6

Insurance+Pension: Pension Layout of 12 Insurance Companies

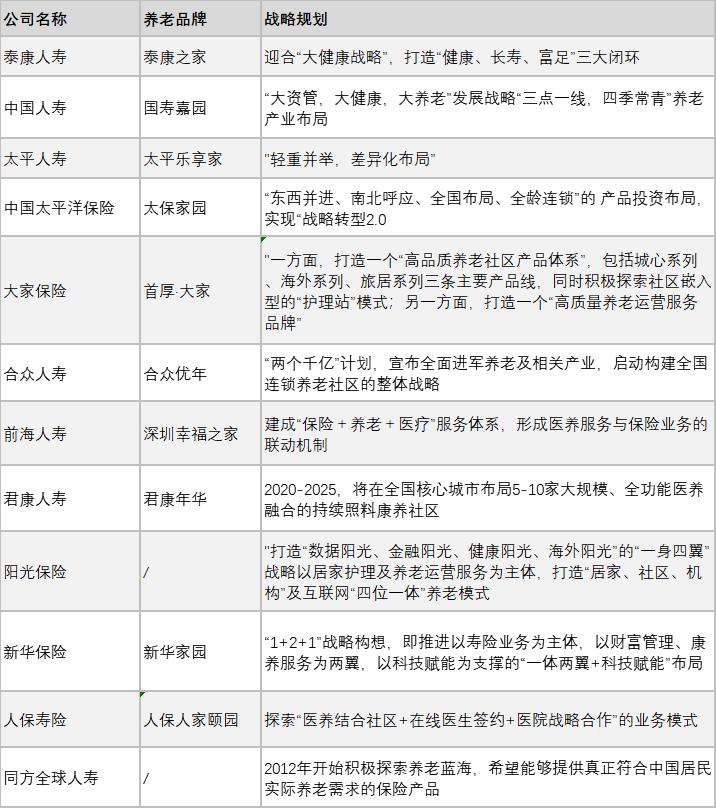

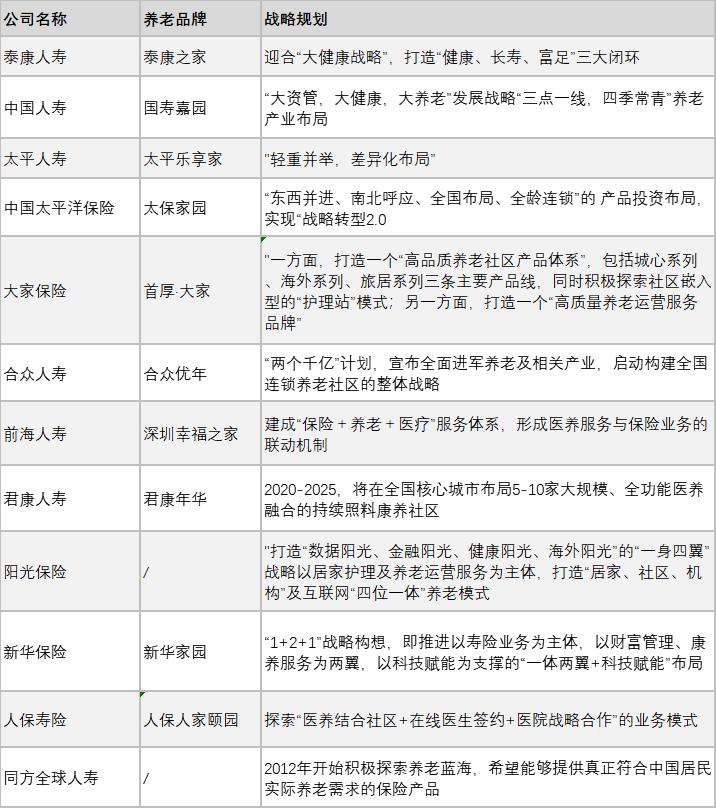

After combing the history of insurance companies’ pension development, AgeLifePro also counted 12 insurance companies with pension projects, and their corresponding pension brands and strategic plans:

one

Taikang Life Insurance Co.,Ltd.

Pension business product line

1. The product plan of the happiness contract endowment insurance;

2. Taikang House (CCRC).

Asset type

1. Emphasis on asset layout, self-built and self-operated, with a total investment of more than 20 billion yuan;

2. It has the first-Mover advantage, the firmest strategy, the closest pace, the largest investment and the largest number of policies sold.

profit model

Insurance+asset management+operation.

Pension project

Figure: Taikang’s national layout

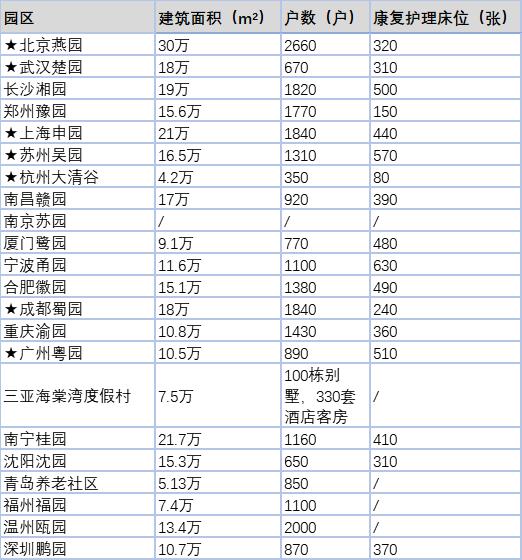

List of Taikang Community (with ★ indicating that the community has opened)

Charging mode

1. Happiness has an old-age insurance plan, and you can stay in the old-age community after paying a premium of 2 million yuan;

2. Insurance (premium over 2 million)+deposit (200,000 entry fee +120/180/360 Le Tai card)+monthly fee mode.

medical service

1. Self-built hospitals: equipped with secondary rehabilitation hospitals, of which the rehabilitation hospitals in Yanyuan, Shenyuan, chu garden, Yueyuan, Shuyuan and Wuyuan have been put into operation, and the hospitals in Beijing, Shanghai, Guangzhou and Chengdu have been included in the designated medical institutions for medical insurance, and they can enjoy medical insurance reimbursement for medical treatment;

2. Medical resources: build an international standard tertiary general hospital, Taikang (Nanjing) Xianlin Gulou Hospital, Taikang Tongji (Wuhan) Hospital, Taikang Southwest Medical Center (to be established), Taikang Shenzhen Qianhai International Hospital (to be established), Taikang Ningbo Hospital (to be established) and Taikang Baibo Dental;

3. Cooperate with many well-known domestic 3A hospitals to realize two-way referral, green channel, telemedicine and expert consultation services.

2

China Life Insurance

Pension business product line

1. Community for the Aged (CCRC);

2. Community home-based care for the aged;

3. Living.

Asset type

By the end of 2017, the investment scale in the health and old-age care industry was nearly 25 billion yuan, with emphasis on asset layout and self-construction, which was steady and steady.

profit model

Great asset management, great health and great old-age care.

Pension project

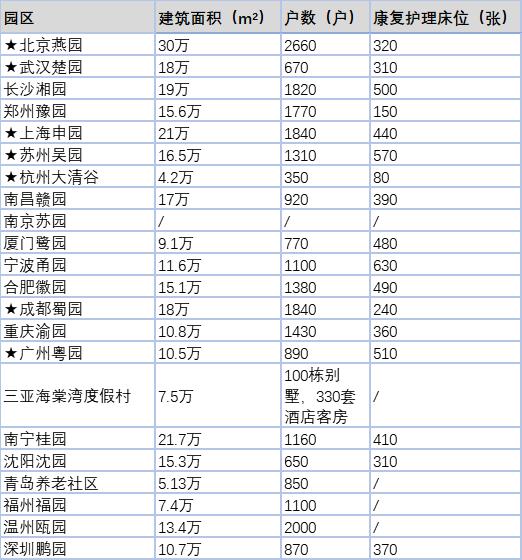

Photo: Guoshou Jiayuan

List of China Life Pension Projects (with ★ indicating that the community has opened)

Charging mode

1. The mode of "deposit (100,000 yuan)+Jiayuan card (90/150/1.8 million yuan)+monthly fee" is adopted for the pricing of self-care area;

2. The nursing area adopts the model of "deposit+monthly fee".

medical service

In addition to providing medical resources in the community and providing 24-hour medical security, it also cooperates with nearby 3A hospitals to open green channels.

three

Taiping life insurance

Pension business product line

1. Taiping Life Insurance Personal Tax Extension Pension Insurance (2018);

2. Community for the Aged (CCRC).

Asset type

1. Shanghai Wutong family invested nearly 4 billion yuan, self-built and self-operated;

2. We are accelerating cooperation with other pension institutions and integrating resources extensively.

profit model

Create a closed-loop service in the whole life cycle from health management and pension industry, and form an industrial ecological chain of "insurance+health+medical care".

Pension project

Figure: Layout of Taiping Life Insurance Pension Project

Taiping Happy Family Pension Project includes: Shanghai Wutong Family, Shanghai Happy Home, Ningbo Xingjian Lanting, Dalian Yijinghui, Kunming Ancient Yunnan Famous City, Beijing Contemporary Time Li, Suzhou Hecheng, Sanya Haitang Family and Hangzhou Langhe International Medical Center, all of which have been opened.

Most of these pension projects are cooperative projects. Only the Shanghai Wutong Family Project is self-built and self-operated. The project covers a total area of 280 mu, with more than 1,500 healthy and energetic apartments for the elderly and nearly 900 beds for rehabilitation and nursing, which can serve about 3,500 elderly people by then.

The designated cooperative units of Taiping Life Insurance’s pension service experience include: Yuenianhua Support Center (Shenzhen), Runhua Songhe Support Center (Shenzhen) and Zangmashan Support Community (Qingdao).

The Wenjiang project in Chengdu is about to land, and projects in Zhuhai and Nanning are also being actively promoted.

Charging mode

1. Purchase insurance products linked to the Wutong family community, and you will be eligible for occupancy if the premium is more than 2 million yuan; Directly purchase the community membership of Wutong family, and pay monthly after check-in;

2. Deposit+monthly fee.

Number of existing beds

Shanghai Wutong family has 288 beds.

medical service

1. Shanghai Taiping Rehabilitation Hospital has been completed;

2. The Wutong family is close to Zhangjiang Science City, which is a new comprehensive medical park integrating "medicine, teaching, research and production" and is rich in surrounding medical resources;

3. Cooperate with hospitals around the community to get through the green channel.

four

China Pacific insurance

Photo: layout of old-age care in Taibao home

Pension business product line

The trinity product system of "supporting the elderly in suburban areas (middle-aged people aged 70-79), living and enjoying (young people aged 50-69) and urban health care (over 80 years old)".

Asset type

1. Pay attention to the investment in assets, give full play to the advantages of backwardness, have a clear strategy and a clear style of play;

In 2.3-5 years, the initial investment will be 10 billion yuan, and 8,000-10,000 sets of high-end pension apartments will be expanded, with 10,000-12,000 beds.

profit model

Comprehensive solution of "insurance products+community for the aged+professional services".

Pension project

medical service

Docking local medical resources and cooperating with surrounding hospitals.

five

Everyone insurance

Pension business product line

1. Community for the Aged (CCRC);

2. Community embedded nursing station.

Asset type

Give priority to light assets.

profit model

1. Create the mode of "providing for the aged in the city" and explore the mode of "nursing station" embedded in the community;

2. Relying on the unique overseas pension license of Everyone Insurance Group, we will lay out our capabilities around four aspects: "operation, nursing, medical care and informatization" and integrate and export pension operation services and brands.

Pension project

Figure: The first thick pension project for everyone

1. The building area of Shouhou Dajia Chaoyang Community is 40,000m, with 230 beds;

2. Shouhou Friendship Community has 545 beds;

3. Fuwai Community for the Aged and the first embedded nursing station in the community are under construction, which can provide more than 1,500 beds.

Charging mode

1. The membership mode is between 1.9 million and 2.6 million;

2. The monthly fee is 15,000-22,000 yuan/month.

medical service

Create a graded diagnosis and treatment service system, including four-tier service settings: medical institutions in the community, remote consultation of Internet hospital experts and remote distribution of drugs, nearest service of 3A hospitals, high-end physical examination and overseas diagnosis and treatment.

six

Union life insurance

Pension business product line

1. Community for the Aged (CCRC, AAC);

2. Physical old-age security plan-buy union insurance and live in an old-age community;

3. Living and supporting the elderly.

Asset type

1. Build a community for the aged with heavy assets and invest 26.8 billion yuan to build projects in Wuhan, Hefei and Shenyang;

2. Investing in light assets to acquire pension communities at home and abroad.

profit model

Invest, run the community, and cooperate with the third party to carry out living and providing for the aged.

Pension project

Figure: Hezhong Pension Health Industry Layout (taken in 2015)

1. Hezhong Younian Life Wuhan Community is the first pension community invested and operated by an insurance company in China, with a construction area of 1.6 million m, 600 CCRC beds and about 1,000 AAC (Active Elderly Community) units, which can accommodate 3,000 people;

2. Hezhong Younian life Nanning community can accommodate 2000 people;

3. Hezhong Younian Life Shenyang Community can accommodate 559 people;

4. Invest and acquire 56 pension communities at home and abroad.

Charging mode

1. Policy+physical endowment insurance plan, you can stay in the old-age community by paying 500,000-750,000 yuan;

2. Deposit+monthly fee mode;

3. You can enjoy the service of living and providing for the aged by purchasing the old card for excellent years.

medical service

Construction of medical rehabilitation centers, medical and health service centers, and docking with local medical resources.

seven

Qianhai life insurance

Pension business product line

1. Establish a happy home for the elderly;

2. Combination of medical care and nursing: set up a medical and health management center, link high-quality domestic medical and nursing resources, operate a medical and nursing combination project, and form a national medical and nursing network;

3. Carry out old-age care services for migratory birds.

Asset type

The hospitals and nursing homes under Qianhai Life Insurance are self-built and self-operated, creating a precedent for the insurance industry.

profit model

Establish a service system of "insurance+pension+medical care" to link medical care services with insurance business.

Pension project

Photo: Qianhai Life Insurance Shenzhen Happy Home

1. Shenzhen Happy Home Nursing Home is a pension project fully invested and operated by Qianhai Life Insurance Co., Ltd., covering an area of 10,860m2, with a total construction area of 33,400m2 and more than 500 planned nursing beds;

2. Plan to invest in the construction of many hospitals, outpatient departments and comprehensive pension apartments in Guangzhou, Nanning, Xi ‘an and Shaoguan.

Charging mode

1. Buy insurance to stay in the community;

2. Deposit+monthly fee mode.

medical service

1. There is a health management center in the nursing home of Happy Home, equipped with a professional health management team;

2. Established the Guangzhou General Physician of Qianhai Life Insurance, and will also build a medical cooperation station with Baoan District People’s Hospital to jointly build a comprehensive diagnosis demonstration model for senile diseases and build a family bed demonstration base;

3. Cooperate with Shenzhen Hospital of Southern Medical University and other hospitals to open a green medical channel.

eight

Junkang China life

Pension business product line

Four product lines with Kangyang Community, Kangyang Hotel, Kangyang Center and Health Resort as the core have been constructed.

Asset type

Combining light and heavy, it is estimated that the total investment will be more than 7 billion, and the company will hold and operate for a long time after the community is completed.

profit model

Integrating insurance products, community pension, medical care and health management services, the insurance products focusing on old-age care supporting Junkang Nianhua Kangyang Community are composed of Junkang Happiness Annuity Insurance (dividend-sharing type) and Junkang Premium Account Annuity Insurance (universal type).

Pension project

Photo: Junkang Nianhua Pension Community

There are Junkang Beijing Nianhua shunyi new town Kangyang Community and Junkang Nianhua Shanghai Minhang Pujin Kangyang Community. More than 2,500 living units are planned and constructed, which will be held and operated by the company for a long time after completion.

Charging mode

Customers who purchase the "Junkang Happiness Lifelong Pension Plan" with a premium of 2 million will enjoy the guaranteed right to stay in Junkang Nianhua Kangyang Community and enjoy the preferential price policy for staying in the community in the future.

medical service

Cooperate with neighboring hospitals.

nine

Sunshine insurance

Pension business product line

1. Take home care and pension operation services as the main body, and build a "four-in-one" pension model of "home, community, institution" and Internet;

2. Establish Sunshine Yikang Pension Service Co., Ltd. and Beijing Yihe Tianxiang Pension Service Co., Ltd..

Asset type

Light assets.

Pension project

Photo: Sunshine Family Guangzhou Kangyang Community, which was put into operation on December 24, 2020.

1. Sunshine Yikang Pension Service Co., Ltd. has jurisdiction over Yikang Home Tiantongyuan Store, Sunshine Jishan Maintenance Center and Xinhu Sunshine Retirement Center (public and private);

2. Beijing Yihe Tianxiang Pension Service Co., Ltd. has established three parent care institutions in Beijing, Dashilan Pension Care Center, Sunshine Li Elderly Care Home and Sunshine Family (Guangzhou).

Charging mode

Deposit+monthly fee mode.

medical service

Medical care stations are set up in the hospital of the institution to connect with local medical resources.

10

Xinhua insurance

Pension business product line

After four years, three typical projects have formed a multi-product pension industry layout that combines suburbs and echoes the north and south, covering three product lines: rehabilitation care, continuous care and old-age health care.

Asset type

Heavy asset investment.

Pension project

Photo: Xinhua Home Community

1. Beijing Lianhuachi nursing apartment with 206 rooms and 360 beds;

2. Hainan Boao Leisure and Holiday Pension Community, with about 1,000 rooms in the first phase;

3. An active community for the aged (to be established) in Yanqing District of Beijing, with 1,800 rooms and 3,200 beds planned.

Charging mode

Charge mode of bed fee+nursing service fee.

medical service

1. Establish Xinhua Zhuoyue Health Investment Management Co., Ltd.;

2. Self-built rehabilitation hospitals and institutions have medical offices;

3. Cooperate with neighboring hospitals to open up green channels.

11

Picc life insurance

Pension business product line

CCRC。

Pension project

Photo: People’s Health Care Dalian Yiyuan Pension Community

The first community for the aged-People’s Insurance and Health Care Dalian Yiyuan Community for the Aged and Health Care can provide about 1,100 old-age care/health care units, and 323 old-age care units in the first old-age care area have been officially put into operation.

Charging mode

"Insurance policy+check-in confirmation letter" mode, with priority for paying 450,000 yuan.

medical service

Actively explore the business model of "combining medical care with community+online doctor signing+hospital strategic cooperation", and provide the "combining medical care with nursing care" health care service for the elderly with disease treatment, disease-free prevention and rehabilitation after illness.

twelve

Tongfang Global Life

Photo: Tongfang Global Life joined hands with Tsinghua University Institute of Economics and Management.

Release the survey report of China residents’ retirement preparation index.

Pension business product line

1. Pension apartments, CCRC, and cooperative construction of nursing homes;

2. Cooperate with Tiandi Health City to launch a "self-satisfaction club" medical care solution and create a "pension+medical care+insurance" model.

Asset type

We will introduce a new model of providing for the elderly that integrates "medical care, support and insurance" and "light assets".

Pension project

1. Tongfang Global Life Retirement Paradise project based on pension apartment solution has been completed in Qingdao;

2. Tongfang Global Life Pension Community (CCRC) project will be listed in the near future;

3. Join hands with Hunhe Ruiyi ‘an Nursing Home in Xiangyang, Hubei Province, benchmark the international level, and lock the target customers into those who need immediate care, so as to prepare for the introduction of disability insurance and long-term care insurance;

4. Cooperate with Tiandi Health City (CCRC) to launch the "Self-satisfied Club" medical care solution.

Charging mode

The "Self-satisfied Club" medical care service solution is in cooperation with Shanghai Tiandi Health City, which is of the same origin. Customers can enjoy the exclusive right to use the old-age service apartment after purchasing the designated products of Tongfang Global Life and paying the membership fee.

medical service

Carry out strategic cooperation with Nanjing Tongren Hospital and strengthen the in-depth cooperation between commercial insurance and medical institutions.

part7

Various ways for insurance companies to develop old-age care

1, with the help of the group’s internal resources to build a community for the aged.

This model appeared in the early stage of the exploration of pension real estate. Some large-scale insurance parent groups have diversified business formats, and there are professional real estate companies under them. They often use the internal resources of the group to set up projects for elderly housing, and the successful projects can be sold to the market. In fact, the selling community model is no different from real estate development, which can quickly recover funds and obtain development profits, thus realizing rolling development. However, under this model, it is difficult to guarantee the community’s old-age service.

The "Comprehensive Service Community for Health Care and Pension" built by Ping An Insurance in the early days was developed and constructed in conjunction with China Ping An Real Estate Group, which integrated three product lines: pension apartment, family community and holiday leisure, with a total construction area of 1.5 million square meters.

The project adopts the mode of "both renting and selling", that is, like commercial real estate, property rights can be bought and sold. Member products are operated by Ping An Real Estate, which only rents and does not sell. At that time, this model was the only pension real estate developed in the form of "selling+holding operation" in the financial department.

Figure: Health Valley Member Service System

Evergrande Real Estate, the parent group of Evergrande Life Insurance, has built the Evergrande Health Valley, creating four parks, namely, Yiyang, Changle, Kangyi and Parent-child, providing 852 types of facilities and 867 comprehensive health management services, covering the whole life cycle from pre-pregnancy, infants to centenarians.

At present, the completed Evergrande Health Valley has been sold to the market. It is understood that Evergrande Health Valley will provide health care and old-age care services to customers through the membership mechanism of "rent, purchase and travel". Customers can become members by renting, buying products in Health Valley or traveling and living in Health Valley, and get membership rights such as health insurance, high-end medical care, health management and health care services.

Evergrande Life put forward the strategic model of "insurance guarantee+ecological pension+combination of medical care and nursing care", and issued the permanent endowment insurance, which creatively combined insurance products with the old-age community to provide customers with a package of pension plans linking financial planning and pension entity services.

Photo: Everbright Peace of Mind Pension Plan

Everbright Life Insurance launched the "Everbright Peace of Mind Pension Plan", which connects insurance products with Everbright Huichen Pension Service Community to provide customers with a package of pension solutions of "insurance+pension community" and realize the combination of financial products and physical pension. "Everbright Peace of Mind Pension Plan" is divided into two sub-plans:

Plan A serves mid-to-high-end customers through "insurance+long-term care for the aged+preferential service for the aged living in residence", and locks in the occupancy right of Everbright Community in advance for customers. The occupancy right is further divided into "guaranteed occupancy right, priority occupancy right, preferential price right, experience occupancy right", etc., to provide customers with more and clearer protection, with up to six rights holders, including not only customers and their spouses, but also parents of both parties. In addition, the right holder can also enjoy the service of living and providing for the aged at preferential prices all over the country from the date of insurance;

The content of plan B is "insurance+preferential right of living service", with low payment threshold and wider coverage. Six rights holders can enjoy the same level of living service in plan A in advance without staying in the old-age community.

In 2019, Xingbao launched "Star Pension"-a comprehensive solution of pension insurance and pension community. Relying on Fosun Real Estate’s Healthy Honeycomb Platform, the two parties jointly create an exclusive pension community scheme for Fosun Prudential Life Insurance customers-customers can reserve pension annuity by purchasing corresponding insurance products of Fosun Prudential, and Fosun Real Estate promises the rights and interests of customers to stay in the "Fosun Pension Community" in the future. It is reported that if the total premium is more than 2 million, the insured can get the qualification to live in an old-age community.

China Merchants Guanyi Home launched the "Renhe Yijia Comprehensive Pension Plan", with the development strategy of "the same platform, giving equal attention to both light and heavy, and combining medical care with nursing care". China Merchants Renhe Life Insurance focuses on the whole industrial chain of pension insurance products, pension community development and pension community operation services.

Specifically, the pension community in Guangzhou Golden Valley (Renhe Yijia Heyuan) is only open to customers who buy insurance. Only by purchasing more than ten designated insurance products, including "China Merchants Renhe Zhaoying Jinsheng Annuity Insurance" and "China Merchants Renhe Heyue Life whole life insurance", and the accumulated premium payable reaches more than 2 million, can they be eligible to apply for the pension community.

2. Innovative gameplay of insurance+pension

Figure: UC club membership rights

China Insurance launched the UC Club of New Life, and launched membership service for the junior and old people. Members who join the club can enjoy services such as learning, medical care, traveling, doing something and having fun. It is also known that United Life also has plans to form a new senior club.

Guohua Life Insurance has established three companies on medical health and old-age care: Hainan Guohua Kangyang Co., Ltd., Gongqingcheng Zhongke Xukang Medical Industry Investment Partnership, and Guohua Residence Kangyang Co., Ltd. At present, the company’s work in medical care, old-age care and other aspects is in the preparatory stage, and there is no more definite information to disclose.

Love Life put forward the four-in-one ecological strategy of "medical care and insurance" for the aged. In 2020, China International Fair for Trade in Services released the first "insurance+service" home-based care product in the industry-"Love+Home-based Care Product Plan", which provides home-based care solutions for the elderly with the combination of "annuity protection+medical care service".

In addition, Love Life is also a pilot agency for long-term care insurance in Beijing, and has set up a special team with rich experience in care management services, and has become one of the eight financial institutions selected by China Banking and Insurance Regulatory Commission Financial Support Community Home Care Service Agency Project.

Happy Life, supported by the national policy, launched the reverse mortgage pension insurance product "Happy House Laibao reverse mortgage pension insurance for the elderly (Clause A)", and invested in regional leading pension institutions all over the country through the special equity investment fund for medical pension.

Zhonghong Life Insurance cooperates with Greenland Kangyang to create a cross-border innovative cooperation model of "insurance products+high-end pension community+Kangyang hotel", organically combining insurance financial products with physical pension services to provide customers with more comprehensive pension solutions. This indicates that Zhonghong Insurance has made important progress in building a "health+pension" dual-engine strategic layout.

tag

Insurance and old-age care both start from the whole life cycle of people, and they are strongly related. Looking at overseas, insurance companies have always been an important pillar of the development of old-age care. The social security and market profitability of providing for the aged coincide with the original meaning of the insurance industry.

On the level of social security, the overall security level of the three-pillar pension system in China is relatively low, with the first pillar dominating, but there are also problems of low security level. Therefore, the participation of commercial insurance can improve the level of social security to a certain extent.

As far as market profitability is concerned, with the improvement of the living standards of the elderly and the enhancement of their ability to pay, the demand of the elderly for commercial insurance products is increasingly prominent, and the inclusiveness of products and services with various asset properties is also increasing. There will be great market space for commercial insurance companies to cut in from this aspect and participate in pension real estate, insurance products and pension services.

In recent years, after the previous heavy lifting asset layout, insurance companies are slowly returning to rationality and becoming more and more clear about their own positioning-"insurance surname". They should form differentiated competition through providing for the aged, innovate services, give full play to the advantages of insurance+and build a big healthy ecosystem.

At the moment when long-term insurance is ready to come out and commercial insurance can play more roles, we believe that all insurance companies will participate in the pension industry in their own ways in the future, which makes us more full of expectations for this industry.

-END-

The content of the article comes from public information collation and AgeLifePro research results. If there is any error, please contact customer service. Thank you.