Deepen the battle against pollution, promote the treatment of new pollutants, and continuously improve the quality of the ecological environment.

Central Committee of Democratic National Construction Association: Perfecting the scientific and technological support and control system of new pollutant treatment

The sources of new pollutants are complex and varied, and they are easy to migrate and accumulate in various environmental media with airflow and water. They have the characteristics of environmental persistence, bioaccumulation and chronic toxicity, and pose a great threat to the ecological environment and human health. China’s "Action Plan for the Treatment of New Pollutants" puts forward the overall working ideas and specific requirements, but it is found that there are still some shortcomings in the treatment process of new pollutants. To this end, it is suggested that:

Strengthen the publicity and guidance of new pollutant control. Intensify publicity on prevention and control of environmental risks of new pollutants, carry out publicity and education on science popularization of new pollutant control, raise people’s awareness of environmental risks brought by new pollutants, and build a pluralistic co-governance pattern of "enterprise subject, government supervision and public participation". Actively carry out international exchanges and cooperation on environmental health standardization of new pollutants, absorb and learn from effective practices and advanced experience, and promote the standardization process of new pollutants.

Strengthen scientific and technological support for the treatment of new pollutants. Find out the source, type and distribution of new pollutants in China, provide support for the coordinated management of multi-environmental media, establish a database of new pollutants, strengthen the application of data science and artificial intelligence technology, identify and predict the diffusion trend of new pollutants and give early warning in time. Optimize and integrate key laboratories, technology centers and scientific research bases in professional fields, increase key technical research on new pollutant control, and achieve innovative breakthroughs in new pollutant hazard identification, environmental monitoring, risk assessment, green substitution, emission reduction technology, treatment and restoration as soon as possible, so as to enhance the scientific and technological support capacity in the whole process.

Improve the management and control system for new pollutants. First, accelerate the legislation of new pollutants, add relevant contents of control and treatment of new pollutants to the existing laws and regulations, strengthen the connection with the management rules and regulations of related industries such as pharmaceuticals, cosmetics and pesticides, and provide legal protection for the treatment of new pollutants. Second, establish a new pollutant discharge standard system as soon as possible, carry out systematic environmental risk screening and assessment, formulate new pollutant discharge limits, quality standards and other indicators, introduce a new pollutant priority list, develop new pollutant standards for key industries and products, and carry out regional pilot projects as soon as possible to form generalizable experience. The third is to strengthen the whole process control of new pollutants. Strictly control the source, strengthen the management, registration, supervision and assessment of relevant producers, importers and processing users, and implement the main responsibility of prevention and control; Strengthen process control, continue to promote clean production and green manufacturing, and promote harmless substitution; Strengthen terminal management, conduct a comprehensive investigation on the consumption and use of new pollutants under key control, and clarify the main body responsible for environmental risks. Strengthen the construction of new pollutant control talents, especially increase technical support and guidance to the grassroots.

Democratic Progressive Party Central Committee: Fight the tough battle of agricultural non-point source pollution prevention and control with the spirit of nailing.

In recent years, the CPC Central Committee and the State Council attached great importance to the prevention and control of agricultural non-point source pollution, and successively issued a series of policies and measures to promote remarkable progress in the prevention and control of agricultural non-point source pollution in China. At the same time, we should also be soberly aware that the infrastructure of agricultural non-point source pollution control is still weak, the awareness of agricultural producers is not strong, the problem of disconnection between farming and breeding is still outstanding, the integrated technology is relatively lacking, the market participation is insufficient, the monitoring of pollutant migration process is lacking, the control standards such as farmland backwater and aquaculture tail water need to be formulated, and the virtuous cycle mechanism combining "dredging" and "blocking" needs to be established, which has become a prominent difficulty in the current ecological environment protection work. In addition to the spirit of nailing nails, we should further promote various key tasks, improve the investment mechanism, long-term management mechanism, low-carbon development mechanism, scientific and technological innovation mechanism, and carry out systematic governance. To this end, it is suggested that:

Improve the policy and mechanism of agricultural non-point source pollution prevention and control. We will promote legislation on the protection of agricultural and rural ecological environment, study and formulate regulations on the prevention and control of agricultural non-point source pollution, and improve supporting policies and standard systems. Improve the management mechanism and promote agricultural production and rural life pollution control as a whole. Improve policy standards, establish input limit standards, fixed-point sales real-name purchase mechanism, improve the agricultural subsidy system oriented to ecological environment objectives, supplement agricultural non-point source pollution monitoring technology and index system, and farmland backwater water quality standards, and establish scientific standards and policy basis for agricultural non-point source pollution assessment and responsibility determination.

Strengthen long-term monitoring of agricultural non-point source pollution sources. In typical irrigation areas and key areas around Poyang Lake, Danjiangkou and black soil areas in Northeast China, long-term joint observation and research of agricultural ecological environment were carried out. Through long-term field observation of meteorology, hydrology, water quality, soil and groundwater, combined with remote sensing technology, the temporal and spatial evolution law of agricultural non-point source pollution was mastered. Strengthen the interconnection or unified management of monitoring data, connect the general survey of agricultural pollution sources, comprehensive utilization information of livestock manure, pollution discharge permit management platform, ecological environment statistics, etc., and build a multi-technology and multi-agent collaborative agricultural non-point source pollution monitoring "one network". Accelerate the application of new monitoring technologies and equipment, strengthen the research and development of traceability analysis technology for agricultural non-point source pollution in river basins, and explore the monitoring of new pollutants.

Strengthen the research and development and popularization of adaptive control technology. Facing China’s agricultural modernization, rural ecosystem protection and restoration, we will strengthen technical reserves and implement technological innovations with multiple objectives such as food security, water environment improvement, carbon neutrality and rural revitalization. The key technologies of agricultural non-point source pollution control will be included in the key core technologies of agriculture, and technology research and development, application promotion and personnel training will be continuously strengthened. We will implement measures such as "source reduction-process interception-recycling-terminal treatment" by region, speed up the establishment of agricultural non-point source pollution prevention and control technology library, form a number of typical prevention and control models, build a number of comprehensive management demonstration projects, and expand the supply of green and high-quality agricultural products in China.

Deepen the popularization of the supreme leader’s ecological civilization thought. Improve public awareness of ecological civilization and form a good atmosphere for the whole society to protect the agricultural ecological environment. Strengthen the popular science propaganda of agricultural non-point source pollution prevention and control, stimulate the green development vitality of agricultural business entities, encourage farmers to participate and supervise, and continuously promote the green and low-carbon transformation of production methods and lifestyles.

Central Committee of the Agricultural Workers’ Party: Continue to fight the tough battle of pollution prevention and control, and strive to build a beautiful China with sky blue, green water and clean soil.

At present, China’s economic and social development has entered a high-quality development stage of accelerating greening and low carbonization. However, the structural, root and trend pressures of ecological environmental protection have not been fundamentally alleviated, and the turning point of improving the quality of ecological environment from quantitative change to qualitative change has not yet arrived. The construction of ecological civilization is still in a critical period of pressure superposition and weight bearing. Therefore, we must maintain strategic strength, continue to fight the tough battle of pollution prevention and control, continue to improve the quality of ecological environment, and continue to enhance the "face value" of beautiful China construction. To this end, it is suggested that:

Continue to deepen the blue sky defense war. Since the first half of this year, under the influence of comprehensive factors, the pressure of basically eliminating heavy pollution weather is still enormous. It is suggested that PM2.5 control should be taken as the main line to strengthen the coordinated emission reduction of PM2.5 and ozone and the coordinated governance of key areas, pay close attention to structural adjustment and promote the in-depth governance of key industries; Focusing on the basic elimination of heavy pollution, the national PM2.5 concentration will be stabilized at "20+" level from point to area, and the national air quality will be continuously improved.

Continue to deepen the defense of clear water. At present, the problem of unbalanced and uncoordinated water ecological environment protection in China is more prominent. The main streams of the Yangtze River and the Yellow River are under great pressure to reach Class II water quality, and the urban and rural environmental infrastructure, especially the urban sewage pipe network, is in debt. Some rivers and lakes are short of water resources, and the water ecosystem is seriously unbalanced. It is suggested that the Yangtze River should be protected and restored, pollution control in industry, agriculture, life and shipping should be promoted as a whole, and pollution control such as phosphorus and manganese should be strengthened, and water ecological restoration should be carried out according to local conditions. Promote the tough battle of ecological management of the Yellow River, effectively guarantee the ecological flow of the main stream and main tributaries, further promote the deterioration of polluted water bodies and the utilization of sewage resources, and implement ecological restoration projects for damaged rivers and lakes; Promote the tough battle of comprehensive management of the Bohai Sea, focus on the Haihe River Basin and the Bohai Sea, strengthen the control of total nitrogen and phosphorus in rivers entering the sea, and strengthen the control of pollutants in coastal cities; We will push forward the battle against urban black and odorous water bodies, coordinate the upstream and downstream, left and right banks, trunk tributaries, cities and villages, comprehensively improve the supervision level of investigation, measurement and retrospective treatment of sewage outlets entering the river, focus on strengthening the construction and transformation of sewage pipe networks in urban villages, old urban areas and urban-rural junctions, and carry out endogenous pollution control and restoration of water bodies according to local conditions.

Continue to deepen the defense of the pure land. The prevention and control of soil pollution in China started late, and the foundation is weak. The progress varies significantly from place to place. The task of prevention and control of pollution sources is generally arduous. Soil pollution continues to accumulate in some areas, and the risk of safe use of soil still exists. It is suggested to continuously strengthen the prevention and control of soil pollution sources, promote the green and low-carbon transformation of soil pollution risk management and restoration, attach importance to the whole process of soil pollution control in large and complex sites, and jointly improve soil health and soil carbon sequestration capacity; Deepen the comprehensive management of solid waste, speed up the filling of shortcomings in medical waste and hazardous waste collection and treatment facilities, prohibit foreign garbage from entering the country, and build a "waste-free city"; Further speed up the filling of the outstanding shortcomings of rural human settlements, coordinate production and lifestyle, and build beautiful countryside with the goal of creating a "clean, orderly, beautified and green" rural environment.

Central Committee of Jiu San Society: Attach importance to and strengthen the treatment of new pollutants in agricultural soil environment

New pollutants refer to toxic and harmful chemicals with the characteristics of biotoxicity, environmental persistence and bioaccumulation. The new pollutants have a variety of biotoxicity, and the risks are hidden. They can accumulate in the environment and organisms for a long time, and have the characteristics of extensive sources and complex treatment, which is difficult to treat and poses a serious threat to the ecological environment and human health. At present, new pollutants have been detected in various environmental media. The research on new pollutants in China is mostly concentrated in the field of water environment, but new pollutants have entered the soil through various channels. Studies have shown that soil has become a potential long-term environmental pollution source of new pollutants and an important link for their migration and transformation.

At present, the main challenges in the prevention and control of new pollution in China’s soil field are: the current situation of new pollutants in soil environment is unclear, the management system of new pollutants is imperfect, and the scientific research related to pollution is lagging behind. To this end, it is suggested that:

Re-investigate and find out the base of new pollutants in soil. Carry out environmental investigation and monitoring of new agricultural pollutants in China, find out the list of chemicals such as drugs and personal care products, perfluorinated compounds, brominated flame retardants, disinfection by-products of drinking water, nanomaterials, microplastics, etc., and carry out detailed information investigation on production, processing and use, quantity and ways of environmental discharge, and hazard characteristics. Establish a new pollution environmental investigation and monitoring system, establish a pollution characteristic database according to pollution characteristics, and dynamically update it according to the investigation. All localities carry out risk assessment on the pollution status of new agricultural pollutants, classify the risk levels, and make full use of modern mapping technology to make a map of the current situation of new agricultural pollutants in the whole region.

Establish a mechanism and establish a sound governance management system. Establish a coordination mechanism. The control of new pollutants is a systematic project, which needs the coordination of multiple departments. It is suggested to establish a coordination mechanism for the control of new pollutants, which is led by the ecological and environmental departments and involves science and technology, finance, housing and urban and rural construction, agriculture and rural areas, market supervision and other departments, hold joint meetings regularly, strengthen joint investigation, joint law enforcement and information sharing among departments, and promote the control of new pollutants as a whole. The establishment of new pollutant control expert database at all levels, to provide policy advice, management support, technical guidance and services for new pollutant control work. Establish the whole process management system of new pollutants, strengthen the source control, process control and terminal treatment of new pollutants, and reduce the environmental risks of new pollutants. Strengthen supervision and law enforcement on the production, processing and use of toxic and harmful chemicals and related products, establish a credit scoring system, and increase penalties for untrustworthy subjects.

Build a platform to strengthen basic research and capacity building. Increase financial input, set up special scientific and technological projects to tackle new pollutants, face the society, and guide scientific research institutions, universities, enterprises and institutions to actively participate in the research and treatment of new agricultural pollutants. Build a research platform, cultivate and create a regional key laboratory of new pollutants. Cultivate professional and technical personnel related to the prevention, monitoring and supervision of new pollutants, strengthen the construction of professional personnel and special training, and strengthen the skills training of existing professional and technical personnel.

Standing Committee member Zhang Quan: Deepening the control of new pollutants and continuously improving the quality of ecological environment

At present, persistent organic pollutants, endocrine disruptors, antibiotics and other new pollutants have attracted more and more attention. The treatment of new pollutants is difficult and complicated, and it is still in its infancy in China as a whole. It is still necessary to further strengthen the work and lay a good combination of laws, regulations, policies, science and technology, and markets. To this end, it is suggested that:

In accordance with the national deployment, accelerate the construction of local laws and regulations on new pollution control. At present, the state is studying and promulgating regulations on environmental risk management of toxic and harmful chemicals. At the same time, all localities should follow up the local legislative work in a timely manner according to the actual situation, and make a good connection with the existing pesticide, veterinary drug, drug management and other related systems and the environmental risk management related systems of toxic and harmful chemicals, further clarify the responsibilities and management requirements of various departments, promote departmental coordination and linkage, fully implement the territorial responsibility for new pollutant control, and establish and improve the mechanism system for new pollutant control.

Focus on key chemical substances and key industries to carry out investigation and monitoring, and do a good job in the whole process of source control, process emission reduction and end treatment. All localities should find out the base as soon as possible, and establish and improve the environmental information database of new pollutants and the environmental risk assessment database. First, strict source control. The relevant state departments should dynamically release the list of new pollutants to be controlled, fully implement the control measures of "one product, one policy", and implement the environmental management registration of new chemicals and the environmental management of toxic chemicals import and export. The second is to strengthen process emission reduction. Promote the supply of local policies, pay attention to the combination of dredging and blocking, implement in stages, encourage clean production and green manufacturing, standardize the management of antibiotic use in human, veterinary and aquaculture, and continue to carry out pesticide reduction and efficiency increase. The third is to deepen terminal governance. Strengthen the collaborative treatment of new pollutants with multiple environmental media, strengthen the management of pollutant discharge permit related to new pollutants, the pilot project of antibiotic treatment in aquaculture, and the pollution control in microplastics. At the same time, strengthen the law enforcement inspection and democratic supervision of people’s congresses and CPPCC at all levels.

Strengthen scientific and technological research to provide technical support for comprehensive management of the whole chain. We will speed up the establishment of an expert committee on the treatment of new pollutants in the region to provide decision-making consultation and technical support for the treatment of new pollutants. Increase investment in research, focus on strengthening the basic research of new pollutants, and strive to form a system of product standards, emission standards, environmental monitoring technical standards and environmental quality standards for key industries related to new pollutants.

Promote regional synergy and incorporate new pollutant control into the Yangtze River Delta regional eco-environmental protection cooperation mechanism. Explore the establishment of regional joint investigation, risk assessment and information sharing mechanisms on new pollutants, formulate a list of new pollutants (chemicals) to be jointly controlled in the region, gradually open up the collaborative control of the upstream and downstream of the industrial chain of new pollutants and the upstream and downstream of the river basin, and bring key new pollutants into the "three unifications" (unified monitoring, unified standards and unified law enforcement) management scope of the regional ecological environment.

Extensive publicity and guidance will be carried out to form a strong joint force for the whole society to participate in the treatment of new pollutants. Carry out publicity and education on science popularization of new pollutant treatment, guide the public to scientifically understand the environmental risks of new pollutants, and establish the concept of green consumption. Encourage the public to report environmental crimes involving new pollutants, and give full play to the role of public opinion supervision. Promote enterprises to implement the main responsibility and guide social capital to participate in the construction of new pollutant control system.

Standing Committee member Cheng Hong: Face up to the pollution around us and strengthen the management of express garbage

According to the survey, the stock ratio of express garbage in some cities is 1/3, and the increase ratio of domestic garbage in megacities is as high as 93%. It has increasingly become a new polluter of solid waste, a new contributor to the siege of garbage, and a new problem in white pollution control since the "plastic limit order". To this end, it is suggested that:

Compulsory elimination of toxic and harmful materials, basically harmless. In view of the universality, rapid growth and harmfulness of express garbage, it is suggested that the State Council should formally bring express garbage into the scope of "plastic limit order" on a larger scale. First of all, speed up the formulation of clear and specific national mandatory standards for express consumables, forcibly eliminate and severely crack down on the production and supply of toxic and harmful express materials, strictly limit non-degradable and environmentally friendly materials, and resolutely control the source. Secondly, we should actively take comprehensive legal, administrative and economic measures to promote the transformation and upgrading of China’s express delivery and embark on the road of green development. These include the comprehensive calculation of big accounts, the huge amount of pollution control expenses after the event will be used for pre-treatment, which will be converted into tax reduction and even rewards, and enterprises will be encouraged to strengthen the research and development of key technologies of green express delivery such as materials, systems and processes, and take a proactive green development path of express delivery.

Contain and reduce excessive packaging, and promote the reduction of express packaging. When formulating relevant laws and regulations in China, we should comprehensively consider economic, social and environmental costs, take into account the legitimate rights and interests of consumers and enterprises, and make specific provisions not only in terms of volume, weight and value, but also in terms of environmental degradation of materials. In actual operation, market supervision and other relevant departments should further integrate their functions after institutional reform, strengthen law enforcement in e-commerce and express logistics, and carry out special rectification of over-packaging of express delivery, so as to urge e-commerce, express delivery enterprises and consumers to establish correct packaging concepts and habits, form a simple and moderate, green and low-carbon lifestyle, and independently realize "slimming" of packaging. At the same time, we should also eliminate violent sorting in the express delivery industry, advocate civilized sorting, take the initiative to eliminate complexity and seek simplicity, and form a virtuous circle of reduced packaging.

Establish an effective mechanism to improve the recovery and recycling of express packaging. Incorporate express packaging into the compulsory recycling package catalogue. We will implement the producer’s responsibility charge system for pollution discharge, and study the introduction of environmental tax on packaging or garbage tax on waste disposal, which will be specially used for the regular recovery, centralized transfer, special treatment and scale reuse of such express garbage. Strengthen law enforcement inspection in the field of recycling and recycling, adopt blacklist publicity system for producers and sellers who violate the regulations, and implement credit management of joint punishment. Vigorously carry out research and development and promotion of recyclable materials and systems in the express delivery industry. Support industry organizations to carry out demonstration projects and cultivate green packaging brands. Competent departments and industry chambers of commerce should also urge enterprises in the express chain to solve problems and adopt innovative mechanisms such as points and mortgages to stimulate and attract consumers and e-commerce to actively participate in the recycling of express packaging.

Redmi K60 Pro

Redmi K60 Pro

Redmi K60 Pro top border

Redmi K60 Pro top border Redmi K60 Pro bottom border

Redmi K60 Pro bottom border

Snapdragon 8 Gen 2

Snapdragon 8 Gen 2 Genshin Impact game frame rate

Genshin Impact game frame rate Frame rate of the glory of the king game

Frame rate of the glory of the king game Redmi K60 Pro Rear Three-camera Module

Redmi K60 Pro Rear Three-camera Module Redmi K60 Pro main photo proofs

Redmi K60 Pro main photo proofs Redmi K60 Pro Super Wide Angle Proof Sheet

Redmi K60 Pro Super Wide Angle Proof Sheet Redmi K60 Pro main photo proofs

Redmi K60 Pro main photo proofs Redmi K60 Pro film effect sample

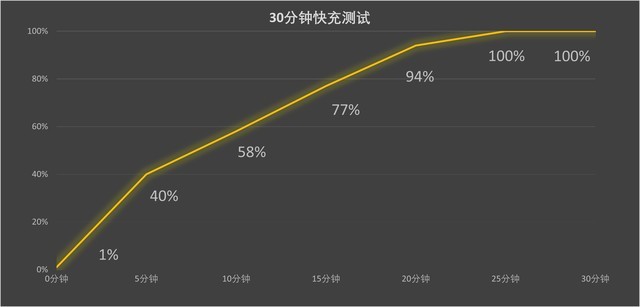

Redmi K60 Pro film effect sample 30-minute fast charge test data

30-minute fast charge test data